We are only about 60 days away from Spring and as we head into the spring of 2022, lending is a primary focus for financial brands. Our current environment leaves financial brands flush with deposits, heading into the start of the seasonal uptick in home buying, while inventory remains a challenge. The market for mortgage lending is competitive. Additionally, commercial and small business lending is built on relationships which have been tested over the last 24 months as businesses of all sizes navigate how to make it through the pandemic.

In this blog, we will cover how client-facing, production roles at your financial brand can leverage LinkedIn for social selling. We will define social selling, share the reasons you should care about social selling, provide tips and best practices, and how your financial brand can support social selling.

What is social selling and why should I care?

We know that 81% of buyers are more likely to engage with a brand that has a strong and professional social media presence. Often when we see a stat like that, we automatically think of the bank or the credit union, but we fail to think about the mortgage or commercial lender and their own brand!

Creating a personal brand for yourself and crafting compelling, unique, and valuable content can help sales leaders expand their audience reach, build a strong referral network, and increase customer engagement – all leading to an increase in the bottom line.

We know consumers and business decision-makers are spending more time online and on social media, averaging two hours per day. Social media sites have become a direct way to connect with target audiences and communicate information about you, your brand, and how you help others.

LinkedIn’s How-to Guide to Social Selling indicates that 78% of social sellers outsell their peers who don’t use social media for selling. In this competitive market, you have an opportunity to differentiate yourself by your brand and social selling. If you are responsible for developing business for your financial brand, 2022 is the year to make social selling part of your sales strategy. If you’re a financial brand, we’re here to help you support social selling while mitigating risk.

78% of social sellers outsell their peers who don’t use social media for selling

LinkedIn’s How-To Guide to Social Selling

Best Practices and Tips for Social Selling

We’ve compiled a list of best practices to implement for social selling. This list not only prompts you with questions to ask of yourself, but also practical content you can start creating today.

Questions to consider:

- What professional resources do you have access to that can supply you with content ideas? (i.e. industry subscriptions, podcasts and blogs)

- What trends are happening in your industry/specific field that you can opine on?

- Who in your network is a center of influence (COI) or referral source?

Pro Tip

Comment on posts that people of influence share to engage with what’s important to them.

Content Ideas:

- Tag people and let your network know who is working with you. (Tip: get permission!)

- Tag and recognize local professionals and businesses who are doing great work in the community or align with your brand and passions

- Highlight your own community involvement, networking events, etc.

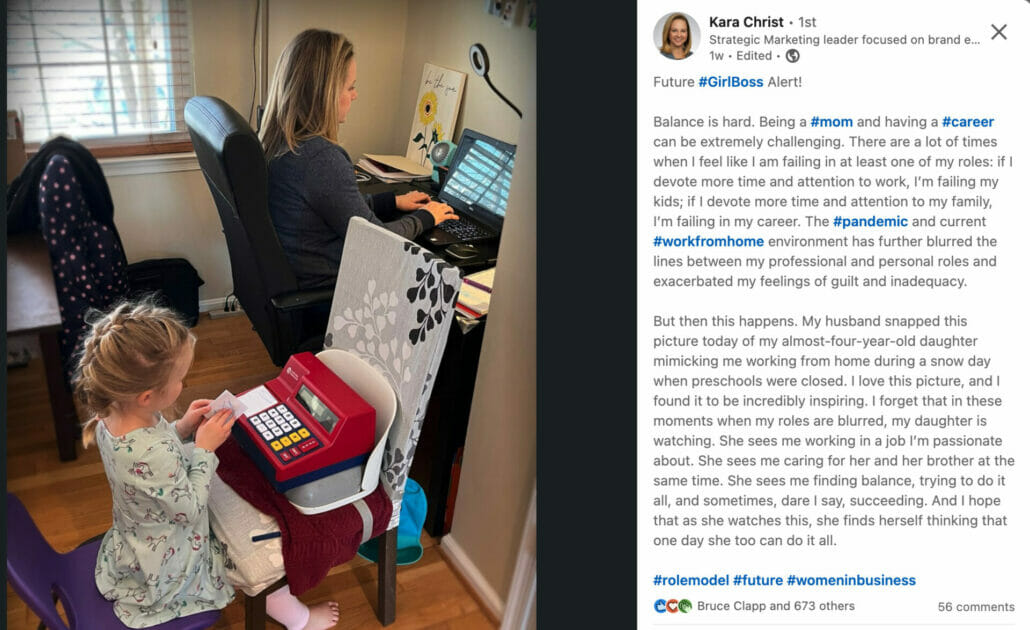

- Show your workplace! (Working from home is real and relatable. I love this post recently shared by a CMO)

- Testimonials! If you serve people well, they are very willing to tell others and celebrate you. Gather those testimonials and highlight them in your content. These endorsements build your credibility.

- Share content written by others who align with your brand (and aren’t competitors!)

Bonus Tips:

- Be real – You don’t have to share everything about your life to be authentic in the social space, but life is real and people want to do business with people who are real.

- Be consistent – make a goal to post and engage on a regular cadence and stick to it!

We hope we have convinced you that social selling is attainable and important to differentiate yourself in 2022. While we are still operating during a pandemic, nurturing relationships and finding alternatives to connect with your COIs will amplify your sales efforts leading to an increase in business opportunities.

If you need more support to implement the social selling strategy, we have a couple additional learning opportunities for you: