Content marketing. When it comes to marketing buzzwords, it’s a common one. From SEO (Search Engine Optimization) to social media, everyone seems to be talking about content (read: content strategy, content marketing, multi-channel content, social content, all the content all the time). But what, exactly, is content marketing, and how should community banks and financial brands be thinking about it and executing on it? Here we’ll break down what can feel like a complicated and time-consuming marketing strategy into some practical tips and insights specifically tailored to community banks and financial brands.

About Content Marketing

Officially, the Content Marketing Institute (an online community and resource center for all things content marketing) defines it as follows: Content marketing is a strategic marketing approach focused on creating and distributing valuable, relevant, and consistent content to attract and retain a clearly defined audience–and, ultimately, to drive profitable customer action. There are several schools of thought on content marketing, but the gist is this: People are very regularly consuming media, but they don’t want to be sold to all the time. They want to be informed, entertained, delighted, and intrigued. Content marketing is the practice of putting out interesting and valuable information and media across multiple platforms that your target audience sees and engages with. In doing so, your brand builds awareness, trust, and traction as a key voice in your industry or community. When done right, content is carefully targeted to folks who find it relevant, reaching them with the right information at the right time in a way that feels natural and organic.

The Advantage of Community Values

This practice of developing valuable content across multiple platforms to build and advance audience awareness is particularly well-suited for community-focused brands and businesses. In the financial services industry, the biggest banks and global financial brands concentrate enormous resources into building campaigns around individual people and communities–hiring agencies to tap into specific stories about specific people in an effort to humanize their brands. For community banks, knowing customers on a deeper level and making a profound impact in their lives is a typical Tuesday.

By design, community banks are pillars. They often come with long histories of generational service and a commitment to helping their communities through natural disasters, crises, and times of need. They have close relationships and partnerships with nonprofits, schools, community groups, and other service organizations. Their employees often hold long tenures and are passionate about the work they do in the community. They participate, host, and sponsor events and gatherings aimed at bringing people together, fundraising, and shining light on underserved needs and groups. They are fundamentally designed to serve their local communities in meaningful ways. When these things are so commonplace and central to the identity of a business, content marketing is an absolutely ideal fit.

Indeed, community banks and community-focused financial brands are uniquely positioned to leverage content marketing–not only to tell real stories about how they’re serving real people, but to educate their audiences about finances, to reach younger and under-banked demographics, and to connect in a way that builds trust and furthers their genuine commitment to serving the community.

Following the Stories

It’s not uncommon for lenders, executives, tellers, and other members of the team to get to know customers and serve them for years–even decades. A small business loan becomes much more; it’s the backing that made a life-long dream–that turned into generations of economic growth for a local family–possible. These are the stories every global brand wants. Real stories about real people remind your audience your brand is more than just a brand; it’s a community-focused group of great people who genuinely care about who they serve.

These stories also provide opportunities for future and potential customers to see themselves in a given outcome. From homeownership to retirement, so much of banking depends on thinking long-term and seeing beyond an immediate need or desire. When people can see how other folks in similar situations pursued a goal, dream, or outcome and did so with the successful support of their bank or financial brand, they’re more likely to not only pursue their own goals and interests, but to call on your bank to support them in those efforts.

So, step one is to find the stories and follow them. This is likely a multi-fold effort that starts with tapping into frontline staff and creating meaningful feedback loops. Start by letting folks across branches know you’re looking for stories about how the bank has made an impact in customers’ lives. Next, create an easy way for them to share stories when they happen and/or after the fact.

More practically, tracking and managing CRA (Community Reinvestment Act) initiatives more effectively can set your marketing team up when it comes to sourcing meaningful stories that fuel truly effective content marketing. If you’re still tracking volunteer service by hand and managing donations and grants in spreadsheets, it can be tough to wrap your arms around the efforts of your staff and bank as a whole and the impact those efforts are making.

Technology can help here in a couple ways. First, by streamlining and consolidating the logistics of tracking information into one central, accessible, real-time platform. The right platform will go a step further, empowering and engaging employees in ways that improve employee and community engagement and make it easy to share those efforts across marketing channels.

Publish Content Across Channels

Finding the story is step one; then you have to tell it. You’ll want to play to the strengths of your team and resources here. Consider what’s ideal, and then take a step back to consider what’s feasible. Take, for example, a success story about how your bank was able to finance a small business owner in an unconventional way to get her and her family into a home better suited for their needs. This is a great story that could work for a number of formats, including a blog, a video interview, a produced and branded video, a social post, and others.

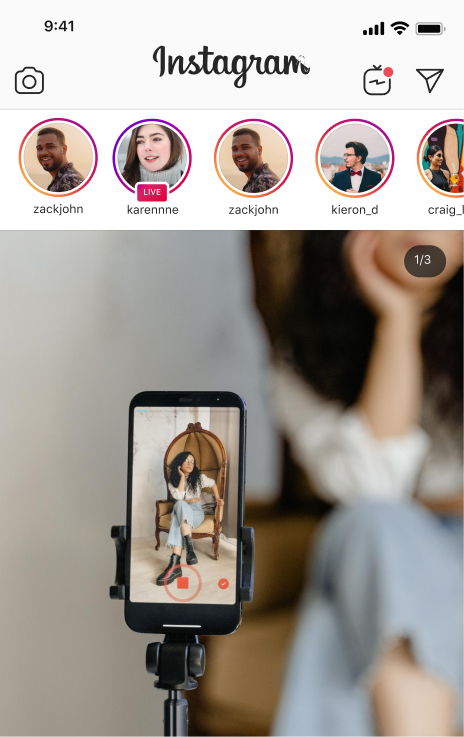

However you ultimately capture the story, you’ll want it to live on your website in one form or another and then utilize other channels to drive people back to your website to consume the story. For example, you might interview the client and use their feedback to write a story for your website that you ultimately publish in the form of a blog. Then you’ll want to create some social posts with teaser content about the story, ultimately linking back to the full story. Perhaps you’ll create some Facebook posts and then some more interactive video snippets for instagram reels. You might also put a blurb about the story in your monthly or quarterly customer newsletter, again driving existing and potential customers back to your website to read it. The net effect is that your story reaches many different types of audiences in their preferred timing and format.

Reach Younger Audiences

Pushing stories about how you’re serving customers and the community and content about those stories to multiple channels and audiences will inevitably lead you to social media. This is ideal, as it’s a go-to source of information, news, and entertainment for younger demographics, including millennials and definitely gen Z.

As a community bank or financial brand, you have a unique opportunity to reach younger and under-banked audiences by providing the kind of information they’re searching for online. Think about topics that are especially relevant to these demographics and plan to put out a series of financial best practices or informative pieces about them. Perhaps your branches are located in a college town with a large population of young graduates and first-time homebuyers. Consider a financial literacy series on the topic. Start with what first-time homebuyers are searching for online, which helps ensure your website is optimized (i.e., discoverable among other websites when folks go searching for these topics on search engines like Google). Try to think about the questions people ask when at this lifestage. How much money do I need for a down payment? How much money should I have in the bank before buying a home? How do interest rates affect my house payment? What does it mean to buy back points, and should I do it? Can I refinance later? These specific topics are great for blog posts. Indeed, the more specific you are in addressing these topics (starting with the actual headline you use for the blog), the more likely your bank website is to come up when folks search for these topics online in your area.

Be sure to share this content in multiple formats. Look for ways to use social media to entice different types of audiences to read your posts. Reels and video snippets can serve as effective teaser content. Quotes from some of the mic-drop moments in your longer story can also attract your audience to read the whole article. The idea is to convey that if folks follow your links and read your content, they’ll gain valuable insights into something unique, interesting, or useful.

As you’re planning content–storytelling pieces about customers, partnership highlights, and educational information–be sure to keep the focus on the customer. These stories are not about the bank. They are, first and foremost, about the people you’re serving and the impact you’re making. Your support, service, and commitment to those people will shine through these incredibly humanized stories when you keep their perspective front and center.

Activate Lenders

The most effective content marketing is authentic.One easy way to maximize content is to empower more people within your organization to produce it. Lenders are a great place to start: The relationship-driven nature of their work means they organically develop a following and become a key resource for updates and information within the community. Empowering them to produce content in connection with your financial brand is the next step. Of course, this can be challenging with branding concerns, loss of control over narratives and how things are explained and displayed–not to mention compliance considerations.

There are certainly ways to activate and empower content creators with control mechanisms and moderation in place. A content management tool specifically for lenders makes it possible for banks to build and manage libraries of pre-approved content that lenders can choose from and publish directly, or modify and then publish with approval. Where you need a compliance checkpoint, be sure to integrate a signoff into your workflow. Look for a platform with labeling and record keeping automatically integrated, so you can seamlessly access archived content distributed by lenders in an organized fashion.

Lenders should also consider longer-form pieces, writing blogs about commercial lending, mortgage trends, the impact of interest rate changes, tips for first-time homebuyers, best practices for real estate investors, and other timely topics their customers and potential customers are searching for. Sharing stories and information from the perspective of loan officers allows financial brands to position their teams as subject matter experts–something readers expect and value in content.

Maximize Your Website

Timely, relevant, engaging content that captures the attention of new and existing customers will start to transition your website from something of a static source of information about your bank or financial brand to a living, breathing piece of marketing. Stated another way, your website should go a step further than informing people: It should encourage them to act and make it possible (and easy!) for them to do so.

People should read the content on your website and want to reach out about working with your bank. So, ask yourself every time you publish a blog, put out a story about a partnership, submit a press release, or build a page on your site: Does this content make people want to work with us?

Getting Started

So, where do you start, and how can your team make all this happen? Start with the story or stories you have, and build communications around them. Think like a journalist to find and uncover the great stories that are happening at your branch locations every day. Consider the processes through which these stories are shared internally and look for ways your marketing team can become part of those processes. Where you can, integrate technology that makes it easier to capture, maximize, manage, and publish these stories across channels in a way that puts the story center-stage and focuses on impact.

Need a hand leveraging content marketing more efficiently and effectively? Submit your information below to learn more about how our teams and technology at Social Assurance can help. Prefer to contact us directly? Email info@socialassurance.com.