Digital transformation. For many community-focused financial brands, they’re the buzzwords at the center of everything from strategic planning to marketing execution. But between the complex digital advertising landscape and the myriad of vendors pitching integrations designed to upgrade customer experience, it’s easy to lose sight of what your customers really want. The answer? Well, the answer is answers. They want answers to their questions and insights from experts. That’s precisely how community-focused financial brands should be thinking about and executing on digital transformation as part of sales, marketing, and customer experience. Indeed, community banks, credit unions, and financial brands that are able to translate their in-branch expertise to digital channels get it–and they’re lightyears ahead of those who can’t or won’t.

Teams are often uniquely equipped to address and advise customers on financial solutions. The goal is to transfer this level of customer service to your website.

In-Branch Versus Online

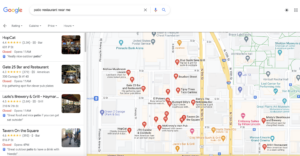

Look, the vast majority of today’s customers are researching, gathering information, and choosing service providers online. In fact, consumer research and survey data collected across industries consistently report that upwards of 80% of shoppers start with an online search. For community banks, credit unions, and financial brands, this means the questions people once asked in person, they’re now taking online to resources like Google. It’s not uncommon for search engines to be fielding all kinds of (sometimes very general questions) about major financial decisions: How do I get the best loan? Is now a good time to buy a car? How do CDs work? How much of a down payment do I need for a house? What’s the best kind of savings account?

When it comes to in-branch service, teams are uniquely equipped to go above and beyond in addressing and advising customers on these kinds of questions. They often have decades of experience and can easily connect with customers to learn more about their unique needs, at the same time aligning offerings that meet and exceed their expectations. But online? Not so much.

To answer these questions in a thorough and meaningful way online–that is, to meet customers’ needs and provide the information they need to take the next steps on something like a loan or account open–community-focused financial brands must serve up relevant answers to online searches. This happens when their websites are structured (read: indexed) in a way that search engines recognize and can read quickly and effectively. It also happens when their sites offer timely, relevant content answering the very questions folks are asking online in a succinct and helpful manner. Unfortunately, what happens instead is often something else entirely.

Missing the Mark

Let’s say a potential borrower heads over to Google and do a quick search for: How to get the best loan. The results quickly reveal that a local community bank has placed an ad on the search (not a bad move, considering what’s been trending on Google search). Unfortunately, the ad directs the user to a page listing all of the bank’s personal banking products.

While it’s great that this bank is implementing a digital strategy and looking for ways to meet customers where they are (online or on their phone, searching for information), the bank in this example is missing the mark in a way that can be extremely frustrating to borrowers.

Think about the user experience. It’s the equivalent of a customer walking into your branch and saying: I’d like to chat with someone about a car loan. To which you respond: Let me give you a comprehensive list of every single thing we offer, from college savings plans and FHA loans to rewards checking and HELOCs. A bank’s leadership would quickly adjust this kind of overwhelming approach to one that’s more personalized and relevant to the customer’s question. The same is required of brands online. But it’s even more important online, because when you miss the mark online, potential customers simply move on–and fast!

The ideal scenario is more akin to the in-branch experience–but likely even faster and easier. A customer interested in a car loan heads to Google, types in their search, and is served up an article written by their nearby community bank or credit union about what to look for in a loan and how to find the best one. Perfect, the user thinks, as they click and follow the article, skimming for relevant information and landing on the context they didn’t previously have in order to ask a more detailed question to begin with. As they’re skimming, a super convenient button prompts them to launch a loan application, and they kick one off right from their (probably mobile) device and input their information. Your team receives the application and follows up right away–answering questions as they arise and working to forge a deeper relationship.

From In-Branch Service to Online Answers

So, what now? How can your sales, marketing, and lender teams leverage online searches to provide answers to the questions that are often step one in a customer or member’s journey toward a financial service? Here are some quick tips and actionable steps in the right direction.

"...when you miss the mark online, potential customers simply move on—and fast!"

Draw people into your site with useful information.

In going digital, your goal should be to draw people back to your website. It’s possible for a single digital ad or social post to convert into an online account open or a loan application, but it usually takes several touchpoints and a little more substance. Refocus on driving traffic back to your website by providing useful and inspiring information. This content should live on your website in a format search engines can pick up.

Create content based on what your customers are asking about.

So what, exactly, is useful or inspiring information? Relevance is key. One of the best ways to find out what people are talking about (read: Googling) is to consult front-line staff. Ask questions like: What have you been asked more than once this week? What are people talking about lately? Then look for opportunities to create blog posts, newsletter content, or other pages on your website that address those topics. You can also check out Google’s trends to see what people are searching for and how popular specific topics are. This can inform your approach to getting traffic back to your website, but also how you generate content for other formats and channels, including videos, social posts, and more. More broadly, addressing these topics with relevant content helps your brand build meaningful authority online–which means that search engines start to view your site as one that people can rely on for this type of information.

Organize information simply and topically.

Many websites suffer from information overload: too much information all in one place. It’s best to focus on one product, topic, or specific issue or question at a time, and devote a whole page to it. Now, there are some more technical tactics for this, including pillar and cluster content methodologies, but the gist of it is simple: Provide a specific and thorough answer to a question and give this topic its own place to live on your site. This also allows you to link back to specifically relevant information in search ads, customer emails, social posts, and other channels. This ensures that folks land exactly where they’re hoping to land on your website, making them more likely to stay there and consume the information they find. Increasing time spent on your pages lowers your bounce rate, which also helps enhance your website’s credibility and authority among search engines.

Make sure your content is working across channels.

A cross-channel strategy allows financial brands to get more mileage out of longer-form content, while also driving meaningful traffic to their website.

One key advantage of organizing content with specificity is that you can use other customer or member touch points to drive traffic to your website and capitalize on cross-selling opportunities. For example, you might put out a monthly newsletter via email to a marketing list of customers or members. Perhaps you’ll include some insights on timely or relevant topics toward the bottom of the email, linking directly to pages on your website where those specific topics are discussed. Pages can also be used within social posts. Perhaps you post a customer testimonial about a phenomenal experience with a small business loan, then link the post directly to a piece about frequently asked questions about small business loans or a case study that takes a more personal look at this specific customer’s experience and tells the story behind their business. This cross-channel strategy allows financial brands to get more mileage out of the longer-form content that can sometimes be time-consuming to produce, while also driving meaningful traffic to their website.

Get people past the homepage.

Driving traffic is great, but you want to make sure people land on and stay within your website–and the deeper the better. Community banks and credit unions sometimes have websites optimized for their homepage, but not for the interior pages of their websites. Imagine how frustrated you’d be if you searched for your favorite historical character while trying to confront your friend in a trivia match and the Google results took you to Wikipedia’s homepage instead of the specific page about that character. You’d skip past Wikipedia and look for search results that actually direct you right to the information you want.

Get a handle on your online listings.

Search engines and online directories (like Google, Yelp, Apple, Alexa, and Yahoo!) are constantly gathering information about your branch and ATM locations so they’re displayed accurately online. This includes information gathered from online customer reviews and the keywords they include. It also includes information gathered from these platforms through mobile prompts that may ask customers to verify your location or hours of operation, for example. If the information found in your online listings is incorrect or unfavorable, the customer or member journey to your website is likely to end before it even begins. On the other hand, if that information is exactly what they’re looking for–you’re in. The bottom line? Your reviews and listings must be actively managed so they’re up-to-date and reflect positively on your organization.

Keeping your online listings updated helps you appear higher in search results.

Getting Started

The digital transformation impacting our industry is exciting, presenting tons of opportunity to connect with existing clients and engage new ones in meaningful and personal ways. But, it can be a little intimidating. If you’re ready to rethink the way you serve clients online, but maybe aren’t quite sure where to start or what next steps to take, Social Assurance can help. We start with a comprehensive SEO audit that gives you a clear picture of how your website is performing and where you are on the road to digital transformation, then help you take the next steps in a way that’s aligned with your goals and your budget.

Reach us directly at info@socialassurance.com or follow the link below to learn more.