April is Financial Literacy Month! It’s an important opportunity for banks to offer critical guidance and information about money management, investing, making purchase decisions, asset management, finding and obtaining loans, and more. Individuals, families, and businesses are often looking to their trusted financial services providers to guide them through the complex and sometimes confusing products and services that can help them along the way. When community banks, credit unions, and financial brands deliver—providing meaningful education and information, they become a reliable resource—one that often translates into a meaningful and mutually beneficial business relationship.

From Financial Literacy Month to Thought Leadership

For community banks, credit unions, and financial brands, Financial Literacy Month can be a great way to kickstart efforts to provide useful information about all kinds of money management topics—and social media is an ideal way to do it. Tailoring your Financial Literacy Month content into short snippets of digestible information and distributing content across social media platforms makes it easier to digest while enabling sales/business development and marketing teams to interact with individuals where they are most active. Social media content also has the potential to reach audiences who may not actively seek financial advice, but find value in discovering it and, in turn, discover your account. The result is great content that reaches new audiences and helps build credibility and goodwill across your community.

What to Post About

When it comes to what to post about, consider a combination of timely, seasonal content as well as tried-and-true, good-to-know stats, facts, and information. Post one or two times per week about financial literacy over the course of the month, and try to hit on a variety of topics. As you’re brainstorming, think about information that might not be common knowledge to unbanked, underbanked, and early-career individuals—like interest rates, personal finance verbiage that can be a little intimidating, asset management, and investing strategies. Keep information clear, interesting, and digestible.

As you’re planning content, be sure to take advantage of these free, ready-to-use graphics and copy created by Social Assurance’s social media and content strategy teams to help community banks, credit unions, and financial brands. These posts can be used as inspiration, supplemental content, or across all your organization’s social channels over the course of the month. Click the download button to get the graphics—then simply copy and paste the corresponding text to complete your posts.

Education is a big investment in your future, and figuring out the financial side of it can feel like solving a complex puzzle. We’ve got your back with some simple tips to help manage those student loans and keep your financial health as bright as your future.

🎓 Understand your loans. Get familiar with loan terms, interest rates, and repayment schedules. Not all loans are created equal, and understanding the details can save you money in the long run.

🎓 Prioritize high-interest loans. If you have loans from multiple lenders or with different amounts, target the high-interest loans. This reduces the amount of interest that accrues on your overall debt over time, saving your hard-earned money.

🎓 Pay more than the minimum.. Aim to pay over the minimum payment on your student loans whenever your budget allows. This reduction in principal means less interest accrues over the life of the loan, leading to savings and a shorter repayment period.

🎓 Set up automatic payments. To avoid the negative impacts of missing a payment, such as decreased credit score and the accumulation of late fees, consider enrolling in automatic payments. Some loan servicers even offer discounts when automatic payments are set up.

#FinancialLiteracyMonth #StudentLoanRepaymentTips

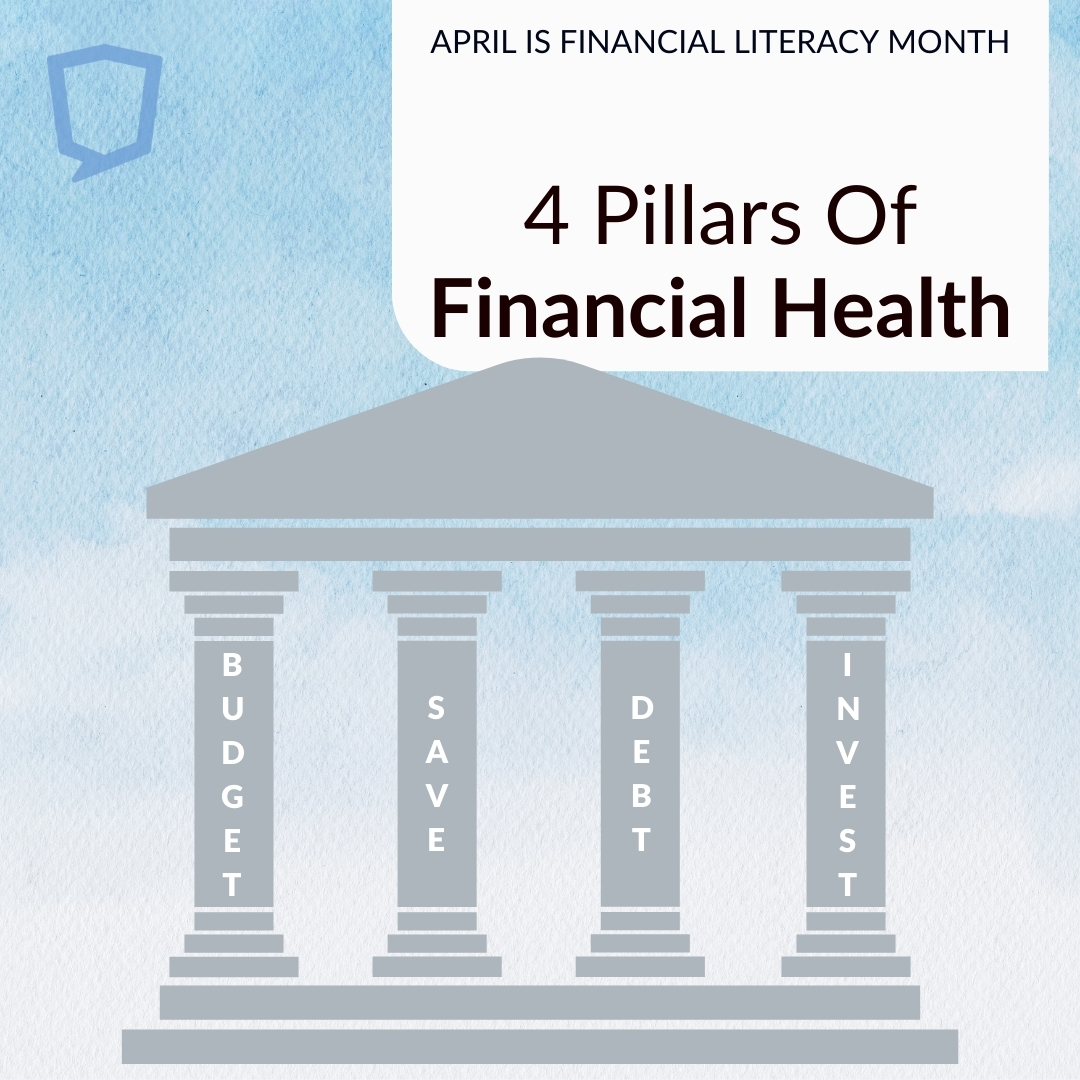

Building your financial knowledge is the key to financial success. There are four key pillars to strong financial health:

🌟 Debt management. Tackle debt strategically to safeguard your financial well-being. Craft a plan to chip away at existing debt and regain control.

🌟 Budgeting. Create a roadmap for your money by aligning your spending habits with savings goals.

🌟 Saving. Secure your future by setting aside funds, whether it’s for short or long-term goals. Explore options like an emergency fund, mutual funds, and more.

🌟 Investing. Potentially enhance your savings by putting funds toward stocks, bonds, and real estate.

🌟 Risk management (bonus!). Assess and mitigate potential risks to your financial stability. Whether through insurance or income diversification, be sure to protect yourself against life’s uncertainties.

Building a firm financial foundation is your shield against life’s challenges. It all starts with these pillars!

#FinancialLiteracyMonth

#FinancialHealth

Fraudsters seem to be getting craftier by the day, which can be a bit unsettling–we know! Here are some simple steps to outsmart them:

🛡️ Mix up your passwords. No two accounts should have the same! This way if one is compromised, the others are still safe.

🛡️ Update your devices. Up-to-date software offers the latest bug fixes and overall better protection.

🛡️ Guard your personal info. Don’t share information like birth dates and email addresses with senders you don’t know.

🛡️ Stay vigilant against phishing emails. If an email seems suspicious, trust your instincts and delete it!

These tips pack a lot of power when it comes to keeping your information safe. Stay savvy; stay secure!

#FinancialLiteracyMonth #FraudProtection

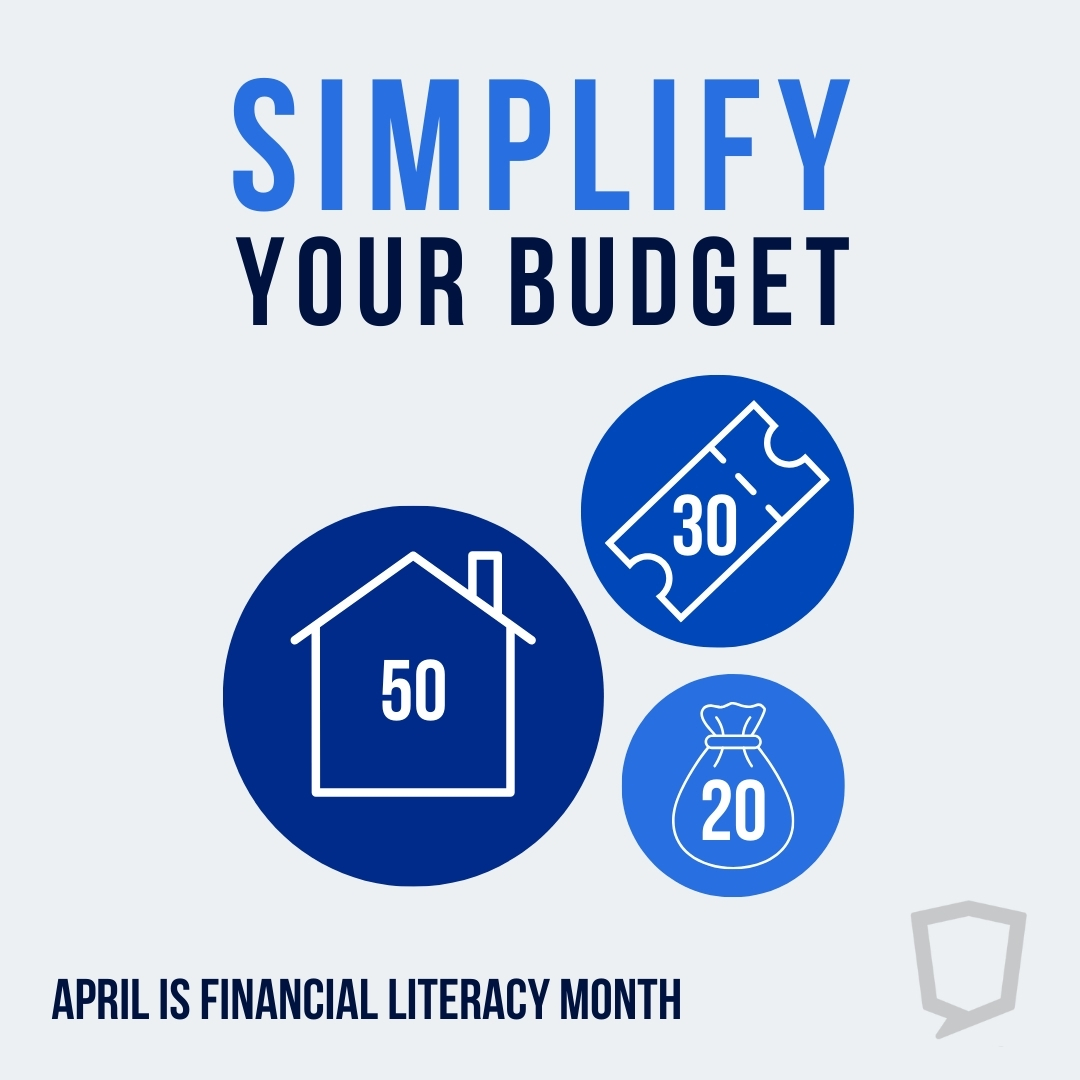

Feeling overwhelmed by your household budget? Let’s make it less daunting with the 50/30/20 method:

🏠 Spend 50% on needs. Think mortgage, groceries, and utilities—essentials to keep your home running smoothly.

🍿 Allocate 30% for wants. Treat yourself guilt-free. Whether it’s dining out or movie night, this is your chance to enjoy the little luxuries.

💰 Set aside 20% for savings. Invest in your future—be it retirement, savings, or debt repayment. It’s your ticket to financial peace of mind.

Ready to take control of your finances? Give the 50/30/20 method a try!

#FinancialLiteracyMonth #BudgetMethod

A CD (Certificate of Deposit) is like a turbocharged savings account. You deposit a lump sum of money, and in return, you get a higher interest rate compared to regular savings accounts. This means more bang for your buck!

Your money stays cozy in the CD for a fixed period, ranging from a few months to several years. During this time, you can’t access it without facing penalties.

This makes CDs perfect for folks who want a safe and predictable way to grow their savings.

#FinancialLiteracyMonth #Money

Several factors influence your credit score. Knowing what defines your credit empowers you to navigate options for major purchases, investments, and other ventures more effectively to achieve long-term goals.

#FinancialLiteracyMonth #CreditEducation

Life can throw curveballs, but having an emergency fund can help you navigate them with confidence. Here’s how to build a robust emergency fund:

1️⃣ Calculate your monthly expenses, including bills, groceries, and other essentials.

2️⃣ Aim to save enough to cover 3 to 6 months’ worth of expenses. Start small if needed, but make consistent contributions.

3️⃣ Keep your emergency fund separate from your regular savings in a high-yield savings account or a money market account for easy access.

4️⃣ Set up automatic transfers from your checking account to your emergency fund to ensure consistency.

5️⃣ Regularly review your fund and adjust your savings goal as needed based on your circumstances.

Being prepared for the unexpected can provide peace of mind and financial stability. Start building your emergency fund today—your future self will thank you!

#FinancialLiteracyMonth #SavingsTips

For businesses looking at financial options, there are many, including small business loans and lines of credit.

A small business loan provides a lump sum of money to a business for specific purposes, such as purchasing equipment, expanding operations, purchasing inventory, or covering other one-time expenses. Small business loans are typically repaid over a fixed term via regular payments. Factors like loan amount, interest rate, and repayment terms are based on the borrower’s creditworthiness and the lender’s criteria.

A business line of credit provides flexibility to cover expenses that are too large for credit cards, typically at a lower interest rate. Instead of a lump-sum loan, borrowers access funds (up to a predetermined limit) as needed. Interest is charged only on the amount borrowed, and the borrower can repay and redraw funds as necessary. Lines of credit are often used for managing cash flow fluctuations, covering short-term expenses, or seizing unexpected opportunities. The interest rates and terms of a line of credit vary based on lender policies and the borrower’s creditworthiness.

#FinancialLiteracyMonth #SupportSmallBusiness

Investing can be daunting, but learning the essentials can help you take the first step. It all begins with a clear vision of your financial goals. When your goals are defined, you can understand which risk tolerances and asset types work best for you. With the right knowledge and strategy, you can navigate these risks and potentially reap great rewards.

#FinancialLiteracyMonth #InvestingBasics

Purchasing a home can be an exciting yet overwhelming time. Make the transition from dreams to keys simple with these quick to-dos:

- Check your credit score and make improvements as needed. The higher your score, the greater your approval chance.

- Put aside funds for a down payment. A larger down payment often makes for better loan terms—like a lower rate.

- Set a budget. It’s not just about how much you can afford, but what feels right. Find the balance between your dream home and financial comfort..

- Find a lender who understands your needs and guides you every step of the way.

There may be bumps in the road, but remember to embrace the adventure. So gear up, get excited, and let the home-buying process begin!

#FinancialLiteracyMonth #HomeBuyingTips

A credit card can help you build your credit score, manage money and savings, and take advantage of some pretty great perks. Here are some things to consider when applying for a credit card.

#FinancialLiteracyMonth #CreditCardEducation

Did you know Social Assurance works with community banks, credit unions, and financial brands nationwide to plan and execute strategic content (including social media!) across channels? That includes website content, blogs, client spotlights, and other long-form storytelling as well as monthly social media content, design work, and campaigns—all planned and executed with compliance in mind. Whether you need to outsource content entirely or just need a little help each month, we’re here to help.