Online channels are critical for banks looking to engage with customers, connect with the community, build trust, and manage their brand and reputation. At the same time, they can provide everyone from individuals to influencers and from brands to celebrity talking heads with the power of visibility. Indeed, viral content can have a swift and sometimes unforgiving influence on consumer confidence and investor relations–making social media and web monitoring and risk management more important than ever. Here are six key things banks need to know right now about monitoring and reputation management.

1. Consolidate Social Media Account Access

Take a look at the processes behind your current social media accounts. Who has access to your pages and handles? How is content planned, drafted, approved, and published? Is your team sending loads of emails back and forth? Taking screenshots? Manually archiving content across platforms in piecemeal spreadsheets? How do you track complaints and other feedback across online listings? Social channels? Other avenues? And how much time and labor does it require from your team? The good news is that the right systems and processes can quickly result in better answers to all these questions (and more).

Centralizing access to your bank’s social media accounts provides a number of key benefits, including: more secure and efficient processes, consistent messaging, and streamlined archival/record-keeping. This also provides the ability to monitor for disinformation, giving your bank a clearer real-time look at online and community sentiment surrounding your brand and the way people are talking about it online. The result is the ability to track complaints and keep records in real-time without the additional time and effort required by manual processes–not to mention the ability to swiftly address potential issues and concerns.

2. Create or Update Policies

To mitigate social media risk, you’ll need to take a hard look at the policies and procedures in place and establish clear guidelines and expectations for employees in various roles. These policies should outline acceptable behavior, including content that should be shared or avoided, and the protocols for addressing customer inquiries or complaints on social media platforms. Providing employees with clear guidelines helps banks minimize the risk of reputational damage and ensures that their social media presence aligns with their brand values. Moreover, educating employees about the potential risks and consequences of inappropriate social media use can help promote responsible online behavior and protect the bank’s reputation.

As you evaluate new technology, access permissions, and processes for approvals and record-keeping, be sure to update formal policies accordingly. In fact, doing so can ensure the widespread adoption and consistent usage of platforms in such a way that ensures rogue communications, posts, and customer interactions don’t go missed in compliance reports. Stated another way, be sure to include the platforms you use to manage compliance workflows, schedule posts, and track content for audits; this will keep teammates from operating outside those platforms.

3. Monitor Social Media Mentions

With the vast amount of content being generated on social media platforms, it is essential for banks to be actively monitoring what is being said about their brand. Tracking and managing that user-generated content can feel overwhelming, and your inclination might be to disengage with social platforms, but you shouldn’t. In fact, it’s crucial that banks maintain an active social media presence so they can consume and course correct disinformation.

Social media listening and monitoring tools allow banks to track mentions, keywords, and hashtags related to their institution, products, and services. Social media management platforms with functionality built specifically for this purpose (like Social Assurance’s Marketing Platform) allow users to gather information from across channels seamlessly in one easily-accessible place.

Monitoring social media commentary across all major channels also allows banks to proactively address misinformation, negative sentiment, or emerging trends that have the potential to impact customer behavior or overall reputation. What’s more, staying informed and engaged in social media conversations can also help banks identify opportunities to improve customer experience and even product and service offerings.

4. Leverage Listening Tools for Web Monitoring

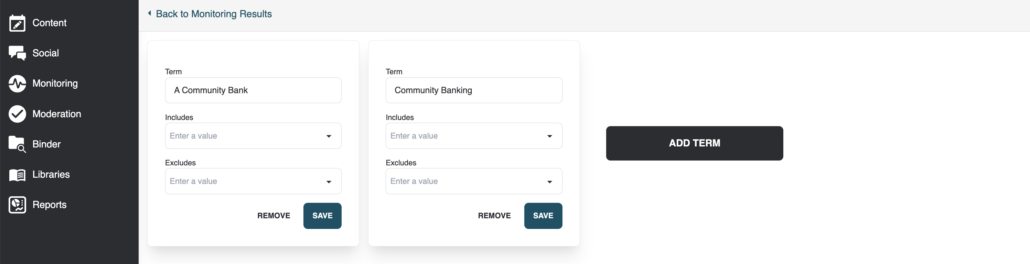

Listening and web monitoring tools make it easy to input specific terms and keywords that trigger notifications. So, for example, your bank might want to set notifications for when its name is mentioned online in published articles, blogs, and other website pages. Social Assurance’s listening tools make it easy to add key terms to a private running list. Be sure to include, of course, the bank’s name, but also its key people: president/CEO, board members, executives, and other influential team members. You’ll also want to include the names of competitors in your areas of operation, any organizations you work closely with or have formal partnerships with who might mention your bank in press releases, events, or other content. Lastly, if you have sister brands or other divisions, or even a foundation, be sure to include those as key terms. Refine listening rules using inclusion and exclusion criteria to keep things relevant. Note that you can also opt for a daily-digest-style notification, so you receive a single email update each day outlining all your key terms in a convenient format.

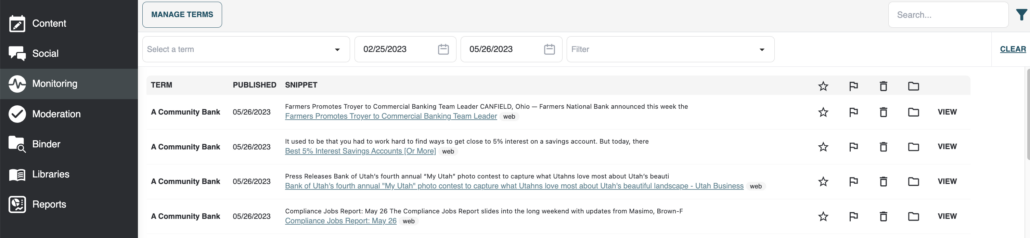

Use Social Assurance’s Monitoring tools to manage web listening and online mentions, including tracking, flaging, screen grabbing, and follow-up actions.

Once articles with key terms in them are on your radar, you’ll want to take the next steps, folding them into your marketing mix as shared positive PR, flagging them for specific follow-up or further action, or archiving them for ongoing record-keeping.

Add keywords and refine the results they yield using inclusion and exclusion criteria within the Social Assurance Marketing Platform.

5. Actively Manage Online Listings

Your bank’s online listings also play into social media monitoring and risk management. Indeed, online listings disseminate information across social media platforms. What does this mean? It means that when a customer is visiting a branch location and is prompted to validate store hours or geographic location for the branch’s Google listing, the information they submit will be validated across other platforms’ data, including geographic coordinates for Instagram, for example. This means quickly and efficiently suppressing incorrect information that can pop up from time to time–including customer-prompted inaccuracies like business hours and ATM locations–is especially important. In short, you’ll want to maintain consistent and up-to-date information across all major platforms so your online listings convey accurate info about services, branch locations, contact information, ATM locations, and operating hours.

In addition to preventing customer confusion and frustration, maintaining accurate listings enhances online visibility, improves search engine rankings, and increases the overall visibility of your bank online (and thus its likelihood of attracting potential customers). Lastly, actively managing online listings ensures that your bank is responsive to reviews and complaints coming through search engines, directories, and review sites.

6. Streamline Processes & Documentation for Audits

A social media management platform with compliance integrated into its functionality allows for access permissions by role–so marketing team members can have the ability to create and schedule content while moderators and compliance teams have approval and publishing access. At the same time, you’ll want to look for a platform built specifically for banks, with compliance workflows and follow-up processes that allow users to manage and assign content where the bank is tagged or mentioned to specific members of your team for follow-up. Further, you’ll want to make sure that those follow-ups get tracked and archived seamlessly for auditing.

When everything goes through a single, securely managed platform, everything is archived in the same place and through the same process, so when it comes time for an audit, you’re ready.

Get Started

Interested in learning more about social media monitoring and how your bank can identify and address the risks associated with it? Social Assurance can help. We work with community banks and credit unions and the major associations that support them to provide compliant, user-friendly social media and marketing management software that saves time, streamlines compliance and record-keeping, and mitigates risk across every major channel. Contact us at info@socialassurance or use the form below to learn more.