In late 2019, when Clark County Credit Union announced its new mission statement, “Helping Our Members Realize Their Financial Goals and Dreams,” it had no idea that it would become such a big part of its members’ financial survival, let alone their dreams, in 2020.

CCCU created a spark of hope and help in its community in 2020 through charitable giving, community events, flexibility and empathy towards its members. CCCU has also stayed connected with its Select Employer Groups as well (first responders, government workers, medical professionals) with visits, education and events. It also brought happiness to college students by bringing back its Smart Start scholarship program, giving $1,000 scholarships to five students.

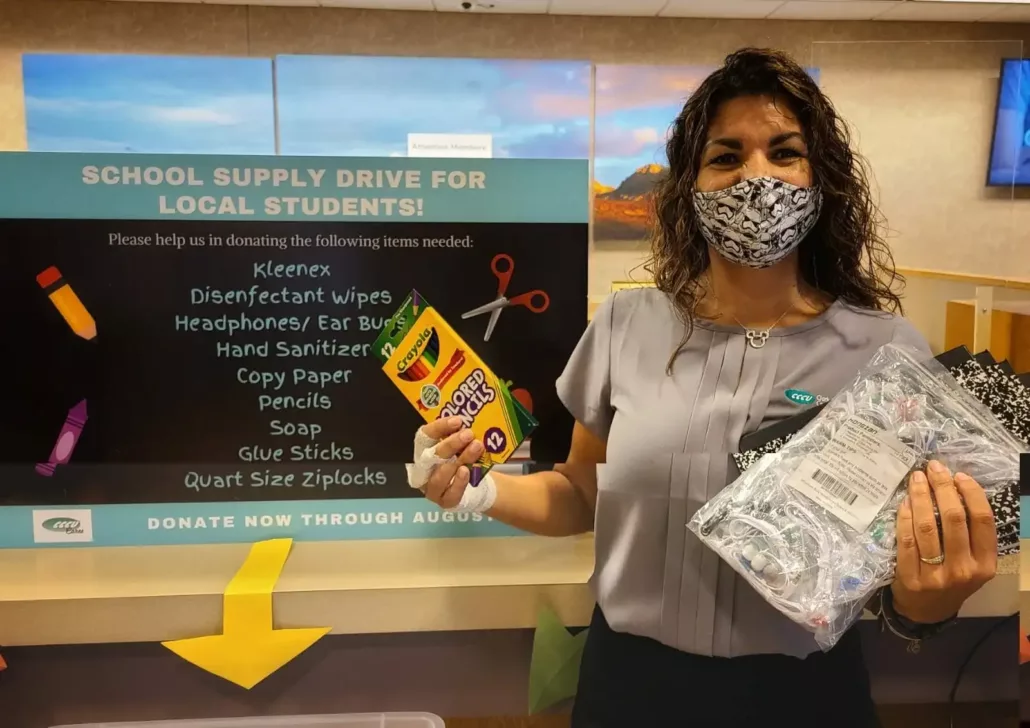

CCCU also supported several nonprofits even while its events went virtual or were postponed. CCCU community events included reading to local students at various schools, donating funds for students to get new shoes and helping students select the perfect pair (Goodie 2 Shoes). It also helped with collecting boxes of dry cereal for homeless teens (Project 150), hosting a school supply drive at seven CCCU locations for low-income students, and participating in a virtual run/walk to raise funds for children receiving medical treatment (Ronald McDonald House). It has also donated about $25,000 to these organizations and others, in addition to funds donated by its members.

In addition to this, the CCCU lending department decided to do a small round of PPP loans to help its existing members. Typically, it has referred out its small business loans, but with the demand so great, its members were not getting enough assistance elsewhere. CCCU’s lending team ended up funding $5.5 million in PPP Loans to support local small businesses.

Its lending department has also taken part in several virtual panels, including one with the Vegas Chamber, to provide guidance for businesses throughout the valley. CCCU’s CLO, Josh Haldeman, was also interviewed by CU Insight and CreditUnion.com to share his expertise on how CCCU has adapted during the pandemic with processes and products.

CCCU also gave its members up to five skip-a-pays on their loans, allowing them to have time to recover from any loss of income. More than 4,700 loan deferrals were awarded, and since May, each month the number of members requesting to skip a payment has gone down.