First things first: Do you have a marketing budget? If not, set one soon!

With Quarter 4 in full swing, it’s time to plan and finalize where you’ll allocate your funds for the upcoming year. Many practices in the financial services industry are rapidly evolving and marketing budgets are fluctuating year-to-year. Deciding where to spend your marketing dollar can be a make-or-break decision for your organization.

Download our Marketing and Compliance report for all the latest trends and insights.

A good budget doesn’t necessarily mean spending more, it means spending smarter.

How should you be allocating your budget?

Set Your Goals

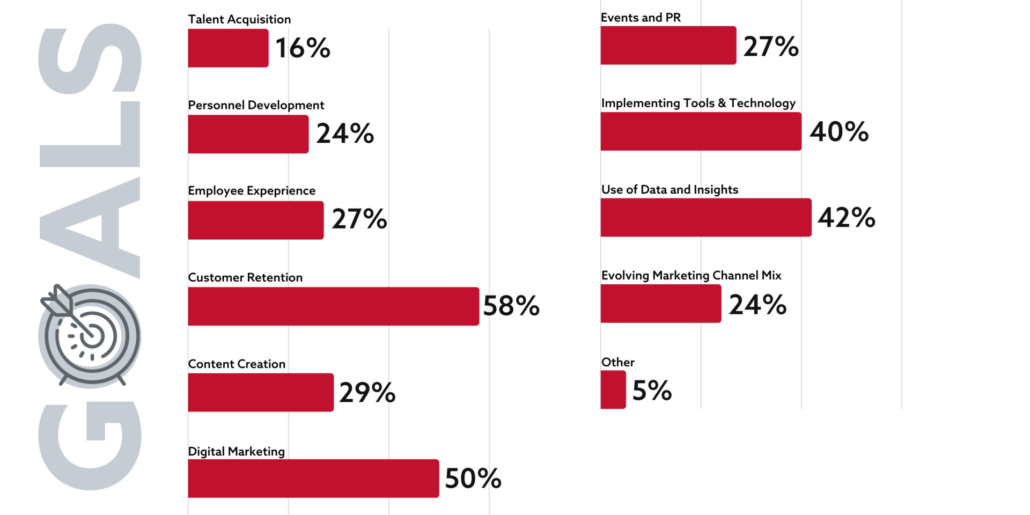

A good marketing budget starts with determining where your financial brand wants to go. Decide company goals early on and let these help guide your marketing budget planning process. Marketing strategies must evolve in order to stay relevant to the modern customer. According to our 2021 Marketing and Compliance Report, financial brands had a few key goals in mind going into 2022.

58% of respondents stated customer retention as the number one priority for 2021-2022. Customer retention, we know, is always a key priority, however, this may also be influenced by financial institutions acquiring new customers and deposits through PPP, along with external influencers like the economy and non-traditional financial institutions causing a significant amount of disruption the past 12-months. The financial services sector is competitive, so the need for customer retention is much more important now.

The second marketing goal financial brands found significant was in the areas of digital marketing and technology. Digital marketing (50%), data and analytics (42%), and implementing tools and technology (40%) were all significant responses, which aligns with where we are seeing both budget and resource investments being made in banks and credit unions. The challenge will continue to be in proving ROI in these areas and having the appropriate skills on the marketing and compliance teams to deploy and manage these new initiatives effectively.

Let’s be real. No one should be setting a marketing budget without knowing where your organization is headed. Setting targets is the first step for any budget plan.

Pro Tip:

After setting goals, be sure to measure and report on your progress regularly. Data-driven decisions allow you to focus on efforts that will have the most ROI and value to the customer.

Make a Plan… a Digital One

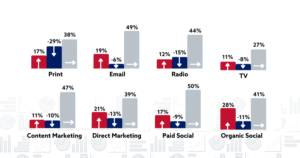

Financial marketers had to do a lot of adapting during the pandemic. Even with vaccinations widely available, consumers continue to prefer digital and touchless methods of communication. Developing an online marketing strategy, consisting of multiple channels, is the first step to establishing your digital presence. A budget that looks more like 60% digital and 40% traditional is an excellent baseline to getting you started in 2022.

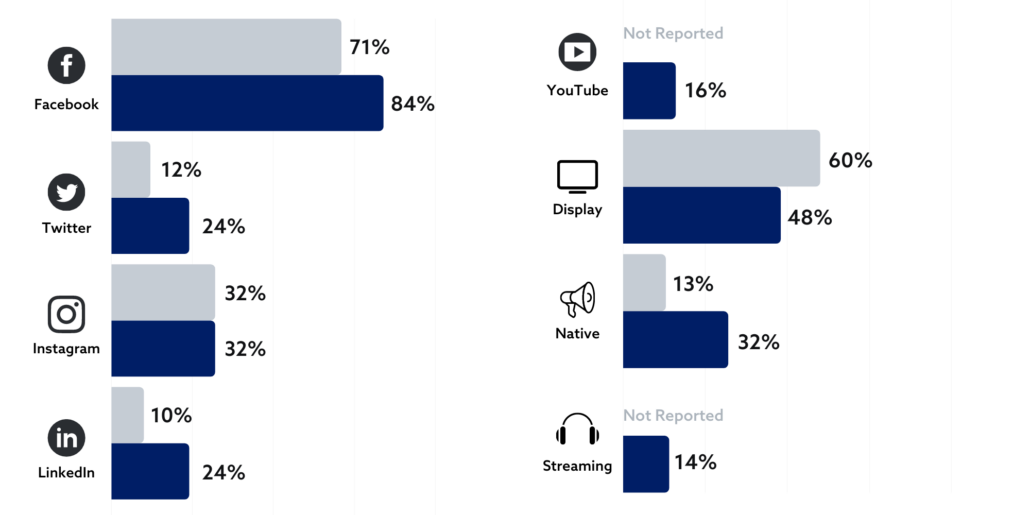

When we start to look deeper into the digital channels that financial institutions are investing in, we saw some very significant increases year over year (YoY), with 84% of respondents citing investing in Facebook for paid advertising (a 13% increase over 2020), Twitter paid advertising at 24%, and LinkedIn advertising at 24%. These last two platforms both having a double digit increase in investment from 2020. Overall, more organizations (+5%) invested in paid social and digital marketing this past year and this will continue to be a trend as we enter 2022.

It is apparent that marketing teams are advancing their digital marketing strategies for both paid and organic efforts. If you’re not even visible online, do you even exist in today’s market? Making investments into digital is a crucial component for growth and brand awareness for your organization.

Pro Tip:

Looking for more resources on paid advertising? We provide a few reasons why your financial brand should be investing in this and what makes it work. Read our blog for more information!

Diversify Your Spend

You don’t need to become the next emerging fintech company to win over customers, however, you must keep up with bank marketing trends to remain competitive.

Banks and credit unions are no longer just on Facebook. They recognize their customer base is complex and diverse, with varying interests and preferences on content consumption. Therefore, financial brands need to be investing in diversifying their channel mix and the content they create for each channel. Your marketing budget needs to allocate funds to all social channels for things like paid advertising or campaigns.

Additionally, the need for accurate online listings and a strong brand reputation is growing. A portion of your 2022 marketing budget should be set aside for managing your online listing and reputation. As more consumers moved their activities online in the past 12-months, businesses have become more aware of the importance of a solid online reputation and review management strategy. Not only to make it easier to be located digitally to service customers, but also how it could be used as an acquisition strategy.

A major component of what determines your online reputation is customer reviews. A lack of online reviews is a huge detriment to your organization’s SEO (Search Engine Optimization) strategy. How active your brand receives – and responds – to customer reviews is a core determinant of your overall search ranking. Investing a portion of your marketing budget into generating customer reviews will help grow your visibility and reach online.

Pro Tip:

Never miss an online mention. Check out our digital listings service that allows you to manage and monitor your financial brand online, here!

Be Flexible.

If we have learned anything over the last two years, it’s that good, agile marketers build flexibility into their marketing plans and budgets. Marketing changes daily. What worked yesterday, might not work today. Being able to shift funds to higher performing channels and activities enables your brand to maximize ROI. Initiate monthly or quarterly evaluations to make adjustments to your tactics and strategies if needed.

As you plan where you’ll allocate your marketing dollar in 2022, remember where you currently stand and where you need to go. Though it’s hard to completely plan for the unexpected, having a flexible budget plan ensures you are positioned well for whatever may come.

Uncover all the industry observations and insights garnered from our annual industry survey.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]