Many consumers struggle with saving and investing.

In fact, nearly 70 percent of Americans have less than $1,000.00 stashed away and six in ten could not afford an unexpected $500 expenses. These are your neighbors and your friends – members of your community that you, as a local financial brand, are well-positioned to help.

A few decades ago, opening a savings or investment account on a laptop wasn’t a possibility. Now, if you need to deposit a check, you can do so with your mobile phone. Because financial services are so much more accessible today, there are more opportunities than ever for your brand to engage with your consumers on financial literacy.

April is Financial Literacy Month, and it’s the perfect time for your brand to educate, encourage, and lead customers to money management success. A lack of knowledge surrounding saving, budgeting, and investing, can lead to poor credit, a lack of preparation for the unexpected, or even bankruptcy. Don’t let these happen to your customers!

Here are a few ideas to tell your customers this month:

Learning About Financial Literacy Never Stops

When we talk about financial literacy, knowing where to start can be a challenge. The best answer: just start. Teaching good money management habits can be as helpful to a 25-year-old as to a 65-year-old. Also, remind your customers that it’s never too early to start learning. Encourage your customers to actively engage their children in saving and budgeting conversations. One in three young adults say their parents are the biggest influence on their personal finance habits.

Pro Tip: If you are a parent looking for ways to involve your children in money management scenarios, try one of these ideas:

- Teach while you grocery shop. Explain your decision-making process and how you budget your spending.

- Play games that involve money like Monopoly or Life.

- Give your children an allowance. This way they can experience money first-hand, and decide how they plan to use their funds.

Promote Your Financial Literacy Programs and Partnerships You Have

Your financial brand is a huge supporter of financial literacy initiatives in your communities. But, the question is, do your customers know that?

There is a growing demand for tools and resources that support individuals throughout their journey to financial independence. Younger millennials and Gen-Z are especially worried about student debt, the housing market, and basic saving and budgeting knowledge. This is where your financial brand can be a key partner for them. Providing access to partner resources like financial calculators or online learning platforms builds trust and connects your brand to these customers.

Pro Tip: Looking for ideas on what to teach? Ask! Post an online poll or a link to a survey where you can ask your online community for what financial topics they would like to learn about most. It helps to foster engagement and ensure that your communications are effective.

Join the Online Conversation

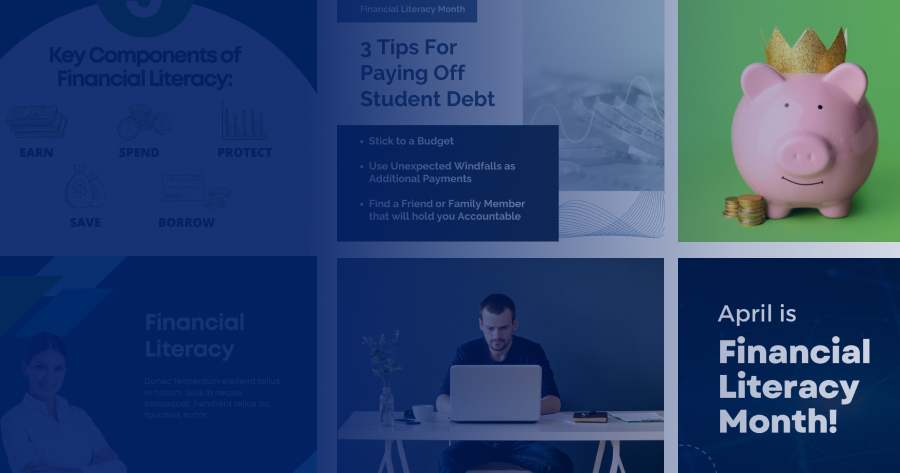

We’ve put together a few example posts your financial brand can share on your social media accounts this month!

Post#1:

5 Key Components of Financial Literacy: Earn, Spend, Save, Borrow, Protect

Example Copy: April is Financial Literacy Month and is a great time to check in on your finances. Maybe thinking about finances leaves you stressed? Maybe you need to save more? You are not alone! Learn more about how to take charge of your finances with our free financial calculators and education programs.

Post #2:

April is Financial Literacy Month!

Example Copy: April is #FinancialLiteracyMonth. Tell us what you are doing to improve your financial wellness this month in the comments below:

Post #3:

3 Tips For Paying Off Student Debt

- Stick to a Budget

- Use Unexpected Windfalls as Additional Payments

- Find a Friend or Family Member that will hold you Accountable

Example Copy: April is Financial Literacy Month! Are you one of the millions of Americans with student debt? Consider these three tips to help you pay off your student loans today. #FinancialLiteracyMonth

How is your financial brand participating in Financial Literacy Month? Be sure to share your available tools and resources this month. Join in on the conversation!