In community banking, impact isn’t just about what you do—it’s about how well you show it. Lending programs that support low-to-moderate income (LMI) borrowers are more than a CRA compliance checkbox; they’re opportunities to live your mission, meet broader goals, and serve the people in your communities who need it most.

But here’s the truth: Innovative programs don’t mean much if no one knows they exist.

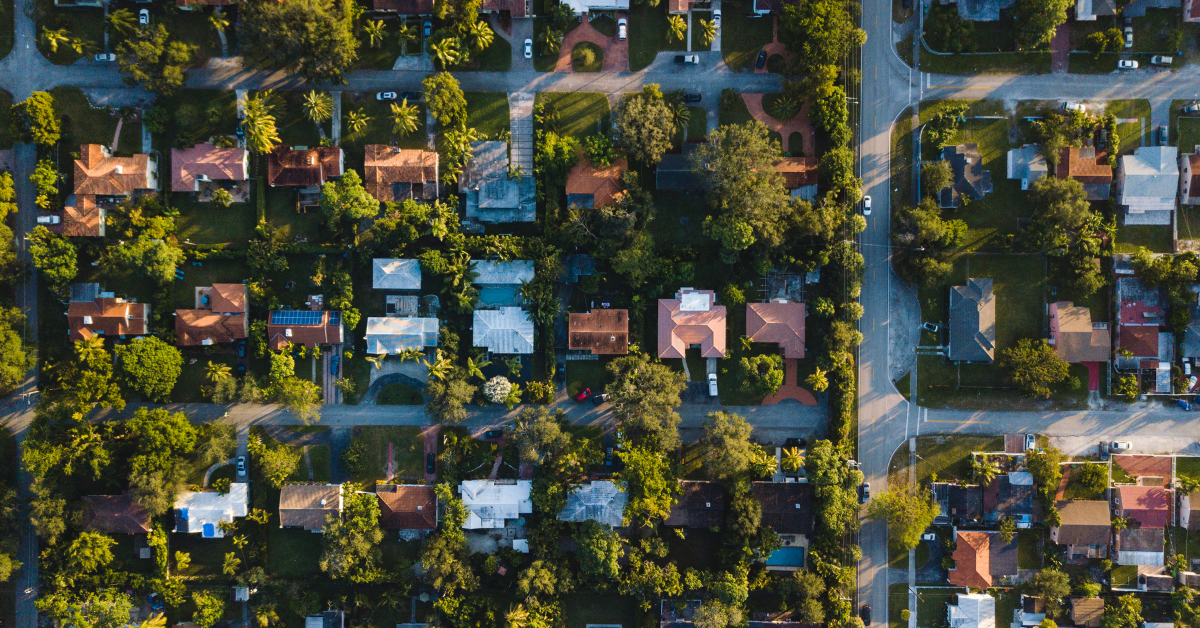

Take a half-amortizing 15-year mortgage, for example. It’s a product structure that can make homeownership more accessible for low-to-moderate-income borrowers by easing early payment burdens while still building long-term equity. It’s the kind of solution community banks are uniquely positioned to offer—responsive, mission-minded, and community-first. And it’s exactly the kind of initiative that deserves to be shared.

In reality, the average consumer likely doesn’t know how this kind of loan could benefit them. And they may not understand the broader implications for more accessible loans–the way they can make a real difference in struggling communities, rural areas, and places facing challenges to crucial industries or difficult economic environments.

Messaging about Lending Innovation

When community-focused financial brands roll out creative products—especially those tailored to rural or lower-to-moderate income markets—they’re not just pursuing new business. They’re delivering on their promise to understand and serve the community in unique and meaningful ways.

A half-amortizing loan, for example, could be a lifeline for families who are income-constrained today but building toward stability. By lowering the initial payment hurdle and backloading principal payments, banks can offer a real path to ownership without pushing borrowers toward 30-year debt commitments.

But here’s the disconnect: many of these offerings stay siloed in lending teams or buried in product menus. Without a strategy to surface and share the real ways these products are used by real people, the story gets lost—and so does the potential to build trust, brand value, and community recognition.

Marketing the Mission: Why It Matters

When banks think about marketing, product ads and rate promos might come to mind first. But for community banks and credit unions, marketing isn’t just about promotion—it’s about storytelling. It’s the vehicle to show your organization’s values in action.

A thoughtfully crafted content strategy centered on real, human stories, can elevate community-driven products in a way that resonates with audiences inside and outside the bank:

- Relating to Needs: For your customers, it’s about showing that you “get it”—you see the challenges and you’re doing something about them.

- Staying ahead of Exams: For regulators, it’s evidence that your LMI-focused lending is more than a numbers game; it’s about making a sincere impact.

- Building Buy-In & Culture: For your staff, it reinforces the connection between what they do every day and the impact it creates.

Authentic, human-centered stories have the power to shift perceptions—not just of the product, but of the organization behind it.

Bridging CRA & Brand with Storytelling

This is where your CRA goals and brand storytelling naturally align. The Community Reinvestment Act asks banks to demonstrate meaningful investment in their local communities, especially in underserved areas. That means tracking efforts like LMI lending, charitable giving, and volunteer hours.

But if that’s where the story ends—in a spreadsheet or compliance report—you’re missing massive opportunities!

When your marketing/communications and CRA teams collaborate, you can turn compliance-driven activity into compelling, compliant content. Stories about real families buying their first home, lenders explaining why this loan structure matters, or branch managers spending time in the community educating and workshopping with those who may benefit—for many community banks, this work is happening! Is it being tracked, though, and tracked properly? And are business development and marketing/PR teams digging deeper into service activities to get to the stories behind them? Then leveraging those stories strategically across channels to paint a bigger picture? That’s the kind of material that humanizes your brand and amplifies your mission.

It’s also the kind of content that strengthens your CRA performance narrative for examiners. When stories support your data, your impact becomes much more tangible.

Sourcing the Story: Making It Sustainable

Of course, knowing the value of these stories and actually capturing them are two different things. It’s so incredibly common for business development and lending teams to be out, engaging with the community, but communications and marketing teams don’t find out until a week or so after the fact, when the moment has passed. At the same time, marketing and compliance teams may be hesitant to have lenders creating their own content without oversight. It turns into something of a rock and a hard place that gets at the crux of why many community banks struggle to consistently collect authentic content from across the organization. Teams are busy, processes are manual, and compliance is necessary.

That’s why it’s critical to have a system in place—a platform with workflows that makes it easy for employees to:

- Log lending activity, volunteer hours, and community involvement

- Track and participate in community events

- Track and manage nonprofit partnerships, donations, and grants

- Manager LMI loans and service areas or import data from a core software seamlessly

- Submit stories, testimonials, and photos alongside community work

- Route those stories to marketing teams

- Loop in compliance for review and approval

- Archive everything in one centralized place

Community Spark from Social Assurance can help! A robust community impact management solution unlike any other, Community Spark makes it easy to collect, track, and showcase the real stories behind your organization’s community impact. Whether it’s a new lending initiative, volunteer hours, or charitable giving, Community Spark gives your team the tools to document efforts, route them for approval, run robust reports, and turn them into compelling, compliant content for social media, digital, your website, newsletter updates, and other key channels.

By connecting community engagement with your marketing and CRA reporting, you don’t just meet regulatory expectations—you elevate your brand and deepen trust with the people you serve.

When you reduce friction between departments and give everyone—from loan officers to marketing—a clear role in storytelling, the stories start to flow. And when they do, your bank doesn’t just look active—it becomes aligned, engaged, and mission-driven in a way that resonates with employees and customers.

Make Community Impact Known

A new loan product may start on a spreadsheet, but its impact lives in the lives it changes. Whether you’re piloting a unique mortgage program or expanding access in an underserved area, the full value of that effort comes to life when it’s shared.

For community banks, storytelling isn’t a luxury—it’s a lever. One that lifts your brand, supports your CRA goals, and most importantly, reflects the people and communities you serve.