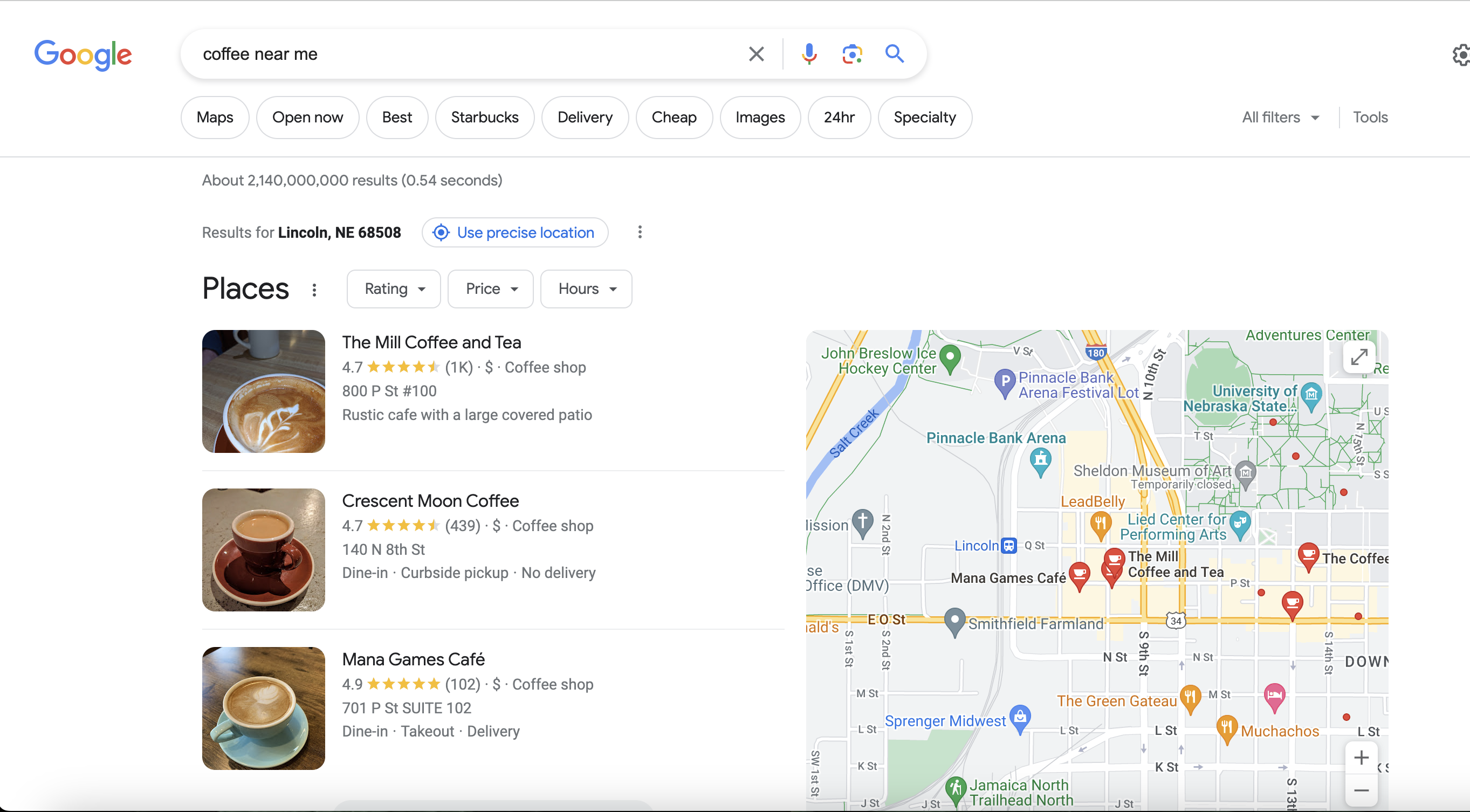

Remember the last time you grabbed your phone and Googled “coffee near me?” The results yielded by a simple near-me search quite often determine the establishments people frequent for everything from car insurance to breakfast. And when it comes to financial services, consumers are increasingly looking local. But, when they Google your organization’s service offerings, do your branch locations appear? The answer to this question depends largely on how actively you manage your digital listings. This guide offers everything you need to know to get a handle on those listings and ensure they reach as many consumers as possible.

What are digital listings?

Online platforms or directories—including search engines, business directories, and social media platforms—house individual listings for businesses. These directories provide a centralized place for businesses to showcase important information across sites that aggregate and verify this data constantly. The goal? To ensure consumers have access to the information they need when they need it. For financial brands, the pertinent data here is your organization’s name, address(es) for branch locations, ATM locations, phone number, website URL, and business hours (drive-through and lobby). It’s essential to maintain accurate and up-to-date information within these databases.

Boosting Visibility & Reach

The most popular place to begin when creating your digital business listings is Google. With Google as the dominant search engine and 64% of consumers using Google Business Profiles to research local businesses, this platform is vital. Every bank, credit union, and financial brand should have an updated and accurate Google Business listing for all locations and service offerings.

Centralizing Information

Create a master spreadsheet that contains all essential details, including name, address, phone number, website URL, business hours, and social media profiles. This will serve as a reference for updating and maintaining consistency across your digital listings.

Monitoring Listings for Accuracy & Consistency

Use online monitoring tools and alerts to receive notifications whenever changes occur or new reviews are posted. This allows you to promptly address inaccuracies, update information, and respond to customer reviews and inquiries.

Ensure your financial brand’s information is consistent across all listings, your website, social media profiles, and other online channels. Any discrepancies confuse search engines and negatively impact your online visibility and reputation.

For Civista Bank, outsourcing the active management of online listings and reputation saved valuable time and resources for a small, scrappy team. “Since we started using Social Assurance’s listings and reputation management, we don’t have to stress about whether the information for our 43 branch locations is correct across all directories and platforms,” explains Civista’s Social Media and Marketing Coordinator Autumn Jose. “Their team manages these listings according to our needs, ensuring we always show up in local online searches. Previously, we had to check for reviews across directories and platforms in order to respond to them. Now, we simply receive a notification when a review comes in for any of our locations from any platform, and we’re able to respond quickly and efficiently. Having a centralized platform to manage our listings and reviews—backed by the support from Social Assurance—lightens our workload and makes our lives so much easier.”

The Importance of Reviews

Reviews are an important piece of the digital listings puzzle. Reviews play a crucial role in enhancing the visibility of your listings on platforms that host your product and service data. When users search for products and services, reviews provide additional information that can increase the likelihood of your listings appearing in search results, especially when they address the specific aspects users are interested in. There are other benefits to reviews, too, especially when they are actively monitored as part of a broader listings and reputation management strategy and execution.

Online reviews provide a public platform for customers to share their experiences. Positive reviews help build a positive reputation, instill trust, and attract new customers. When people search for financial brands in their area, they often read online reviews to make informed decisions.

“With Social Assurance’s listings and reputation tool, we’re notified each time a review is submitted for any of our branch locations. This helps us respond in a timely manner. We can also run a simple report that provides an overview of how each location is doing.”

–Avdic Zehireta, Vice President of Marketing, D.L. Evans Bank

Online reviews also have a substantial impact on visibility in local search results. Search engines (like Google) consider reviews when determining local search rankings and even comb keywords used in reviews to match them to user search terms. Higher review ratings, positive feedback, and relevant keywords in reviews increase your financial brand’s visibility in local map listings and search engine result pages.

Engaging with customers through online reviews allows your financial brand to build and strengthen relationships. Responding to reviews, whether positive or negative, demonstrates attentiveness and a commitment to customer satisfaction—while providing an opportunity for your financial brand to address concerns, offer solutions, and showcase your dedication to serving their community.

How to Get Positive Reviews

Many consumers use a financial brand’s star rating as a deciding factor when deciding where to bank, so proactively seeking out reviews is essential to your marketing and customer acquisition strategy. Implement these practices to generate positive reviews for your financial brand.

- Deliver exceptional customer experiences by focusing on personalized service, addressing customer needs, and going above and beyond expectations. Satisfied customers are more likely to leave positive reviews.

- Actively ask customers for reviews through various channels, such as email, in-branch signage, or follow-up communications. Make it easy for customers to share their experiences by providing direct links to review platforms.

- Respond promptly and professionally to all reviews, both positive and negative. Engaging with customers demonstrates that their feedback is valued and can turn negative experiences into positive ones.

- Highlight positive reviews on your website, social media channels, and marketing materials; these build credibility and encourage others to leave reviews.

This guide is part of our latest series on listings and reputation management, helping you understand the complexities of digital listings and master your financial brand’s online presence.

An All-In-One Listings & Reputation Solution

Managing your digital listings and reputation takes time—a luxury your team may not have. Social Assurance does the heavy lifting for you, deploying our expert Listings and Reputation Management team to help actively manage, monitor, and control your brand’s online presence and reputation. Backed by our expert team, Listings & Reputation Management from Social Assurance ensures accurate information is shared with customers across hundreds of search engines and review sites.