Digital listings help you drive traffic to your branches, increase your brand’s awareness, and offer more opportunities for your customers to find the information they need. These are a vital resource for digital financial marketers, and they demonstrated their value during the events of the COVID-19 pandemic. From providing updated communications to customers to helping financial brand leaders learn how to help the community, digital listings are a critical conduit of information. Best of all, they can be easily inserted into your financial brand’s annual marketing plans.

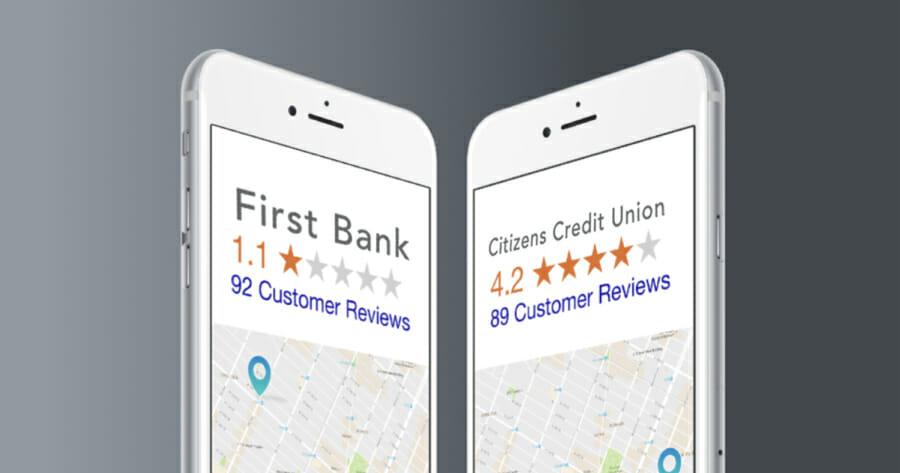

While digital listings are free to set up and use, it does become a time-consuming process – mainly if you don’t use a digital listings management software. Many financial brands are forced to go to different digital listings individually and create and manage them there without this resource. It’s a different story when you work with a software vendor. With this service – such as Social Assurance’s Digital Listings and Reputation Management – your financial brand can manage their digital listings information across thousands of locations across the web to ensure their information’s accuracy while also helping you to respond to reviews.

Digital listings, if it’s not already, should be a crucial part of your 2021 and 2022 marketing strategy. Here are a few ways this resource could play a role.

Send Local Communications

Digital listings were created to help local establishments better connect with their communities. Information on hours, services, and contact information are available, but special messages and announcements are also available. These areas are ideal for providing important communications to customers, from whether masks are required to local events you’re hosting to promote financial communication. Just as your content marketing plan encompasses social media posts, plan for it to expand to digital listings as well.

Pro Tip:

When promoting events or breaking news affecting your branches, add a post to that branch’s digital listings so that your customers can read and find that information easier.

Improve Branch Accessibility

One of the trending areas of focus for financial services marketing has been to make websites ADA compliant. These standards help those less-able to view your website’s information and better interact with your brand. You can incorporate these best practices into your digital listings as well. From including images with alt-text in your branch photos to marking your locations as handicap accessible, there are various ways to make your locations more accessible to everyone. Digital listings can even integrate ride-sharing services such as Uber and Lyft to help those without transportation arrive at your locations.

Pro Tip:

When auditing and improving your website for ADA compliance, copy over these best practices to your digital listings to help improve their accessibility.

Boost Sales and Generate Leads

By now, you know that digital listings are a way for helping customers find more information about your brand – but they can also help your loan officers attract more sales. Digital listings can be created for your loan officers and include their contact information. Much like the ones for your branch, these listings can be optimized to be SEO-friendly and appear in more searches. When customers and potential clients enter “loan officer around me,” your loan officers can show up through these listings and reduce the amount of time and effort it takes clients to find them.

Pro Tip:

Establish compliance processes for your loan officer digital listings similar to those for your branches. This helps to ensure accuracy and compliance of information.

Digital listings are only growing in usage with financial brands – don’t let yours fall behind! We’ve detailed the importance of digital listings and how you can use them to boost your online reputation. This resource could be the key to helping you leave your mark on the community and enable your brand to be remarkable.