A strong online presence is crucial for any business. But there’s an incredibly important component for financial brands, and it’s one that’s often overlooked: digital listings and reputation management. These key elements can significantly enhance brand visibility, attract new customers, and provide valuable insights into your business’s processes and customer experiences.

This quick guide outlines commonly asked questions and misunderstood details about the importance of digital listings and reputation management. With plain-language insights and actionable best practices, you’ll gain the tools you need to effectively manage and integrate these essential components in your financial brand’s marketing strategy.

What Are Digital Listings?

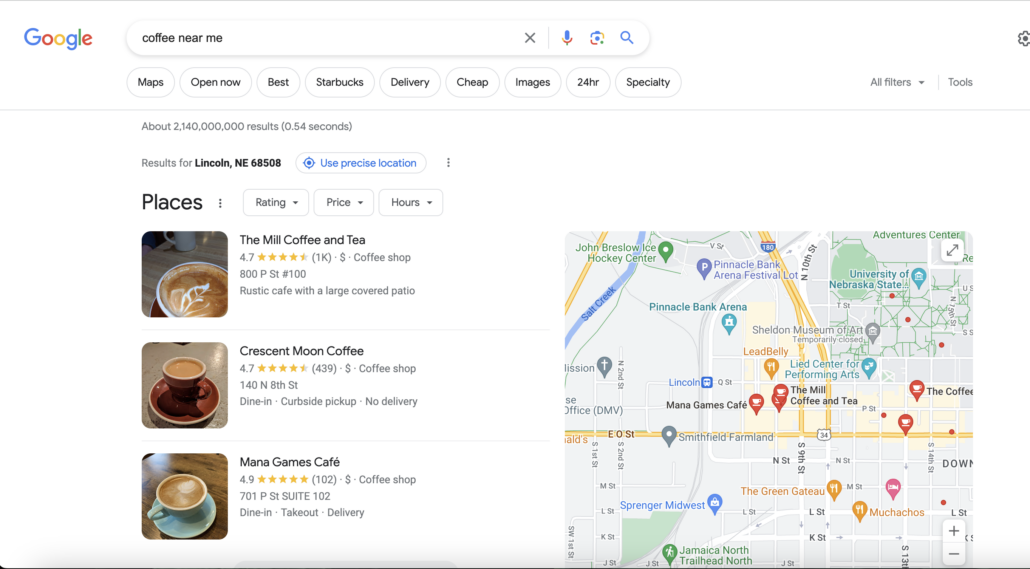

Digital listings help local establishments better connect with their communities, and you’re probably already familiar with them, even if you don’t know the terminology. When, for example, you do a Google search for “coffee near me” and a number of establishments show up in results–you’re viewing business listings for those establishments.

Digital listings help local establishments better connect with their communities, and you’re probably already familiar with them, even if you don’t know the terminology.

More technically, online platforms or directories house individual listings for businesses—including search engines, business directories, and social media platforms—that provide a centralized space for businesses to showcase important information. For financial brands, this is your name, address(es) for branch locations, ATM locations, phone number, website URL, and business hours (drive-through and lobby).

Learn more about how Social Assurance helped American State Bank improve their digital listings and reputation.

Why Do Digital Listings Matter to Financial Brands?

It’s important to manage these listings carefully to ensure they display accurate and consistent information across all platforms and directories. When people hop online to look for nearby services/products, search engines like Google prioritize showing them local, relevant results. By ensuring precise and current listings, you can secure a prominent spot in local search results and boost your visibility among potential customers. And if those listings also feature glowing reviews and ratings that build trust among consumers–well, that’s even better.

Online directories and search aggregators also prompt customers visiting your locations or ATMs, for example, to validate information. They might be asked if store hours are correct or if the location they arrived at was, in fact, the location of the branch. The information they submit is validated across other platforms’ data, including geographic coordinates for Instagram, for example. This user feedback is great in that it keeps information up to date, but it can also be harmful when customers answer incorrectly. This means quickly and efficiently suppressing incorrect information—including customer-prompted inaccuracies like business hours and ATM locations—is especially important.

“Social Assurance makes the process of updating our online information quick, easy, and simple.”

–Torri Adams, Assistant Vice President, American State Bank

How Do Digital Listings Factor into SEO Rankings?

Local SEO is a search engine optimization (SEO) strategy that ensures your organization is more visible in local search results. So, pulling from the previous coffee example, a local coffee shop that is well-optimized for local SEO will appear at the top of user search results related to coffee and similar terms or search criteria.

When your listings are claimed and optimized on platforms like Google Business Profile, Bing, Yelp, and industry-specific directories, they’ll appear higher in search results. On the other hand, if your digital listings aren’t accurate and consistent, your financial brand will appear lower in online searches—and sometimes not at all.

How Do I Know If My Digital Listings Are Accurate?

Your listings show up in numerous directories all over the web, whether you’re actively managing them or not. Start by conducting a search on popular search engines like Google, Bing, Yahoo, and social media sites using relevant keywords related to your financial brand. Keep in mind that people often use sites like Yelp, Yellow Pages, and Nextdoor to search for local businesses, too.

Get a Free Scan of Your Online Rating Instantly

Check the health of your financial brand’s information with our free digital listings scan. Instantly see how your most critical location data appears on Google, Yelp, Facebook, and more apps, search engines, and review sites.

How Can I Optimize Loan Officer Listings for SEO to Attract More Clients?

Did you know digital listings can also help your loan officers attract more sales? Much like branch and ATM listings, these listings include the loan officer’s direct contact information and can be optimized to be SEO-friendly and appear in more searches. When current and potential customers search for something like “loan officer near me,” for example, your loan officers show up through these listings, substantially reducing the amount of time and effort it takes clients to find them.

Take the Next Steps

Interested in getting a handle on your digital listings and online reputation management? Social Assurance is here to help with tools and resources, plus our expert support team. Whether you’re needing to make updates, experiencing a merger or acquisition, or looking for a better way to manage customer reviews, we’re here to help. Contact us to get started.