Hello bank marketer friends! Last week the Social Assurance team attended the ABA Bank Marketing virtual conference at our headquarters in Lincoln, NE. For some of us, it was an opportunity to “meet” our full-time virtual coworkers in person for the first time. After 18 months of being virtual, it was exciting to talk face-to-face without a screen between us and get back to our “social” roots!

While we loved having the team together, we were still bummed to not be in Austin, TX connecting with you in person. But, we made the most of it! In lieu of being together, we wanted to give you four FOMO (Fear of Missing Out) moments you can’t live without.

Moment #1 Andrew Davis, Keynote Speaker & Author

Davis opened the conference with this standout quote on marketing budgets: “Our marketing pizza pie isn’t getting any bigger, it’s just getting sliced more ways.”

Over the years, there have been shifts in the mediums we use to market our brand, and now there are more channels, tactics, and mediums than we can count. So, what happens when these new frontiers come along? Our pizza (aka budget) doesn’t get bigger; we slice our pizza into smaller pieces so we can invest in this new channel or tactic.

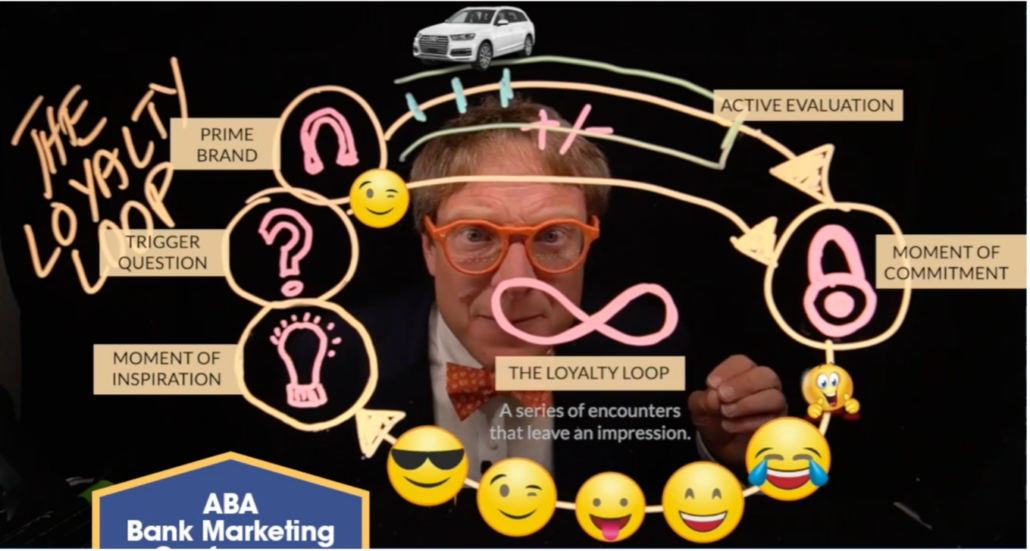

Buying today is not linear. Look at your internet browser – how many tabs do you have open? The Loyalty Loop is Davis’ new model that better represents how people buy today.

The concept is a series of interlocking loops (not linear!) that represent a series of encounters that leave an impression and ultimately build trust with the consumer, which in turn drives revenue. The navigated journey bounces between a variety of experiences including a trigger, moments of inspiration, and active evaluation all leading up to a moment of commitment.

Davis emphasizes that, “people buy an experience.” The past 18 months shed light on the importance for financial brands to keep the experience, not the product, in the forefront of their innovation. Davis continued, “in the sales process, you can tell them that you’re different, but really you need to show them that you’re different.” With nearly 5,000 banks and over 6,000 credit unions in the United States, financial brands need to focus on their differentiator.

Key Takeaway: Bank Marketers, you have a budget that is generally not getting bigger. Your pieces of the budget must be more effective and efficient, working harder for you than ever. Which piece do you need to re-evaluate? Media and paid ads? Data and Google Analytics? Website and CX?

Moment #2 Britney Campbell, SVP Marketing & Public Relations, Legends Bank & HerBank

Every conference should have a unicorn. We’re lucky that this year, we had over 450 unicorns!

Ok, this moment comes as a close association to the conference. Social Assurance had an opportunity to interview Britney right before the conference primarily because we wanted to celebrate bank marketers. Britney describes so eloquently that the role of bank marketing has shifted dramatically. Bank marketers need to be structured, yet innovative, analytic but a storyteller – ultimately, the bank marketer is the unicorn of the bank.

Britney reminds us, “Banking is still a people business.”

She explains how people are the foundation of what we do. People, both employees and customers, keep our doors open. At a time when “digital transformation” is the buzzword of choice, it’s good to be grounded in what fuels our operations: people.

Moment #3 Ben Pankonin, CEO/Founder, Social Assurance

ABA Bank Marketing Conference is not a conference without Ben. Our Social Assurance CEO facilitated a session called “Using Digital to Put Community into Focus”.

He says,

We are in an interesting place in time in the way we think about human connections and the way we transpose those into digital becomes critical to the way we interpret the world as marketers.

It’s only appropriate that Ben referenced his favorite show, Ted Lasso, during his session because there’s a quote that ties so nicely to his point. It goes like this, “I think that you might be so sure that you’re one in a million, that sometimes you forget that out there you’re just one in 11.”

When we think about building trust, whether that’s personal trust or trust with our brands, we need to think back to the reasons we trust people and brands. One of the ways we connect is when we embrace unity when there is a sense of belonging. Ted’s quote is essentially saying “You belong. You serve a purpose. You matter here.”

How are you inspiring a belonging, especially when you are physically further in proximity with your employees/coworkers/community/customers? How are you exploring diversity, acknowledging equity, and activating inclusivity? How are you proving your value to your community?

Moment #4

If you’re already one of our friends, you know we love conversation. Since we couldn’t all be together, we got together as a Social Assurance team. A few of us, each morning before the conference, shared some coffee, talked about what’s going on, both in the Social Assurance world and in the bank marketing space.

While these chats were live on social channels, the great news is that you do not have to have any FOMO if you missed it because those conversations are here for you to watch.