Financial Literacy Month is an exciting opportunity to empower individuals and businesses with important financial knowledge. Community banks, credit unions, and financial brands play a vital role in bridging the financial literacy gap, helping people feel more confident about managing their money.

Why Financial Education Matters

Every day, people face financial decisions that impact their future—from opening a savings account to planning for retirement. By sharing practical, easy-to-understand financial content, community banks and credit unions become trusted educators, helping customers navigate topics like budgeting, credit, investing, and fraud prevention.

Social Media: A Powerful Tool for Financial Education

Social media is where conversations happen. It’s where people ask questions, seek advice, and engage with brands they trust. A strong Financial Literacy Month social strategy puts your brand at the center of these conversations. By delivering bite-sized, actionable financial tips, you’re not just promoting financial wellness—you’re strengthening your organization’s credibility and expanding your reach.

Take the Guesswork Out of Content Creation

Creating valuable content shouldn’t feel overwhelming. This Financial Literacy Month Toolkit provides ready-to-use graphics and captions designed to educate, engage, and inspire your audience. These posts help your business share impactful financial information quickly and easily.

How to Access the Toolkit

Simply fill out a quick form and access a full set of social media posts with graphics created by Social Assurance’s social media and content strategy teams for the month of April. Whether you post them as-is or tweak them to match your brand voice, these resources make financial education simple and effective.

Access your FREE Financial Literacy Month toolkit now.

Here’s a Sneak Peek of a Few Posts in This FREE Toolkit

Want a easy way to grow your savings? Certificates of Deposit (CDs) can help! Scroll through to learn the basics and see if a CD is right for you.

#FinancialLiteracy #CDs #MoneyMatters

Scammers are getting smarter and savvier than ever! Knowing the warning signs can help you protect your money and personal information. Here are some common financial scams to watch out for:

🚨 Phishing Emails & Texts: Scammers pretend to be your bank or credit union, asking for account details. Never click suspicious links or share personal info!

🚨 Too-Good-to-Be-True Investment Offers: If someone promises guaranteed high returns with no risk, it’s likely a scam. Always research before investing.

🚨 Fake Debt Collection Calls: Scammers impersonate debt collectors and pressure you to pay immediately. Verify account information directly with your lender before sending money.

🚨 Overpayment Scams: You receive a check or payment, then the sender asks you to send money back. The check later bounces, leaving you responsible.

🚨 Fraudulent Job Offers: Beware of jobs that ask you to pay upfront for training or supplies. Legitimate employers never require payment to get hired.

Always verify sources, use strong passwords, and report suspicious activity to your bank or credit union.

#FinancialSafety #ScamAlert #ProtectYourMoney

Inflation affects everything from groceries to gas—and even your savings. Understanding how it works can help you make timely financial decisions. Here’s what you need to know:

💲Purchasing Power Shrinks: As prices rise, your dollars buy less. That’s why things cost more over time, from coffee to rent.

💲 Savings Lose Value: If inflation is 5% but your savings account earns 1%, you’re losing money in real terms. Consider high-yield accounts or investments to outpace inflation.

💲 Loan & Mortgage Rates Change: Inflation can drive interest rates up, making new loans more expensive—but if you already have a fixed-rate loan, you’re locked in.

💲 Wages May Not Keep Up: If your salary doesn’t increase at the same rate as inflation, your real income shrinks. Negotiating raises or seeking additional income sources can help.

💲 Investments Can Offer Protection: Assets like stocks, real estate, and inflation-protected bonds often outperform cash over time.

Inflation can be challenging, but with the right strategies, you can keep your money working for you!

#Inflation #MoneyMatters #FinancialPlanning

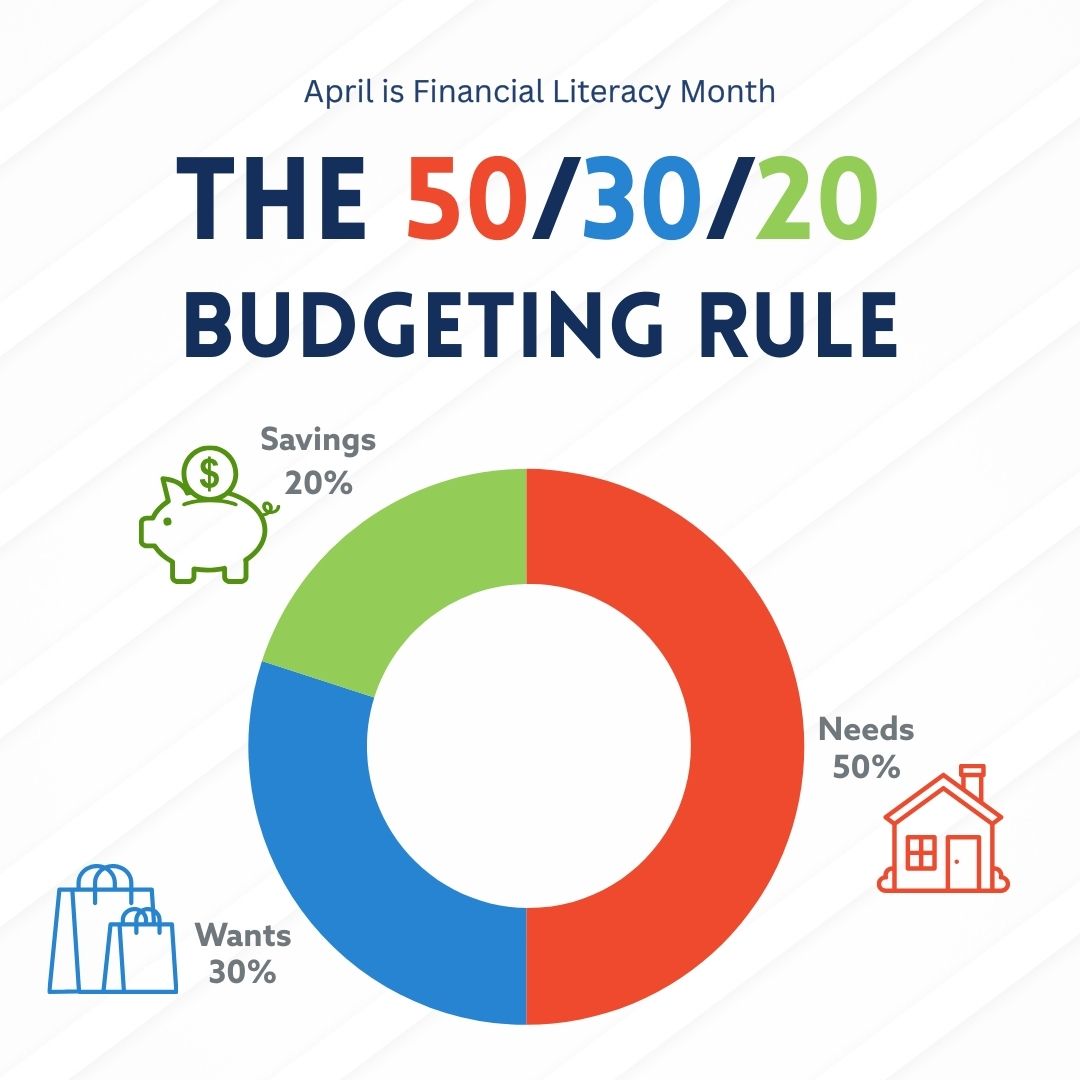

Struggling to balance your spending and saving? The 50/30/20 rule is a simple way to manage your money without overcomplicating your budget! Here’s how it works:

🔹 50% Needs: Rent, utilities, groceries, transportation—anything essential to daily living. If it’s necessary for survival or keeping your household running, it falls into this category.

🔹 30% Wants: Dining out, entertainment, subscriptions—things you enjoy but don’t necessarily need. This category helps you enjoy life while staying financially responsible.

🔹 20% Savings & Debt Repayment: Emergency funds, retirement savings, or paying off loans faster. Prioritizing this portion helps build financial security and reduce future stress.

This method helps you spend responsibly while ensuring you’re saving for the future! Try it out and adjust based on your personal financial goals.

#BudgetingTips #MoneyMatters #FinancialGoals

Did you know Social Assurance works with community banks, credit unions, and financial brands nationwide to plan and execute strategic content (including social media!) across channels? That includes website content, blogs, client spotlights, and other long-form storytelling as well as monthly social media content, design work, and campaigns—all planned and executed with compliance in mind. Whether you need to outsource content entirely or just need a little help each month, we’re here to help.