Wondering what’s next for the financial services industry? We’ve got you covered. Social Assurance’s Marketing and Compliance Report provides an analysis of the financial services industry and explores trends for the upcoming year. This report is intended to serve as a tool for banks and credit unions to gather insights to help inform marketing and compliance investments and evaluate your current and future practices based on industry trends.

Here are a few key takeaways from the 2021 report and how it will impact your brand.

Growing Utilization of Marketing and Compliance Tools and Technology

The pandemic helped shake up some long-held traditional forms of banking and marketing. As the financial services sector continues to adapt to the massive digital disruption, our survey results showed some impressive statistics about Marketing and Compliance technology. Financial marketers have advanced their marketing strategies and implemented new techniques and channels to their mix. The need for efficient and effective workflows for content management, collaboration, and internal compliance approvals has become essential to every marketing technology stack. In this year’s survey, 57% of respondents acknowledged using a software application like Social Assurance offers to help them manage approvals, archival, and marketing reporting. Utilizing technology is something we will see budgeted for in 2022. Organizations have identified the need to evolve their marketing channel mix and move from traditional marketing to digital marketing channels, there is a greater demand for marketing and compliance teams to have effective software solutions in place to support these objectives.

Pro Tip:

Don’t wait to leave your mark. If you want to learn more about our software or if you have questions about its features, request a demo with Social Assurance today!

Compliance Areas of Focus and Concern

Compliance is a critical factor in the daily lives of bank marketers.

What are the top three areas of Marketing and Compliance concern for financial brands? According to our results, it was social media marketing, digital marketing, and UDAAP (Unfair, Deceptive, Abuse Acts, or Practices) compliance.

Although, it is no surprise that marketing and compliance concerns continue to be heavily weighted towards social media (46%) and digital marketing (36%), understanding these challenges and concerns is important. When interacting with consumers on social networks, financial services companies must comply with specific laws and follow regulatory guidance.

Another standout observation, Unfair, Deceptive, or Abusive Acts or Practices (UDAAP), rounds out the top-three regulatory concerns for financial marketing and compliance teams with 31% of respondents stating it is a top-three concern for financial marketing and compliance teams.

These concerns provide an opportunity for marketing and compliance teams to come together for increased collaboration, training, and information sharing. By authentically joining consumers’ conversations – while staying within industry regulations – financial companies can use social channels to foster engagement.

Pro Tip:

Do your internal standards work to meet your goals? If it’s been a while since your organization has asked this question, it may be time to review them. Ensure your team has the proper training and understanding for these compliance concerns.

Marketing Budgets and Trends

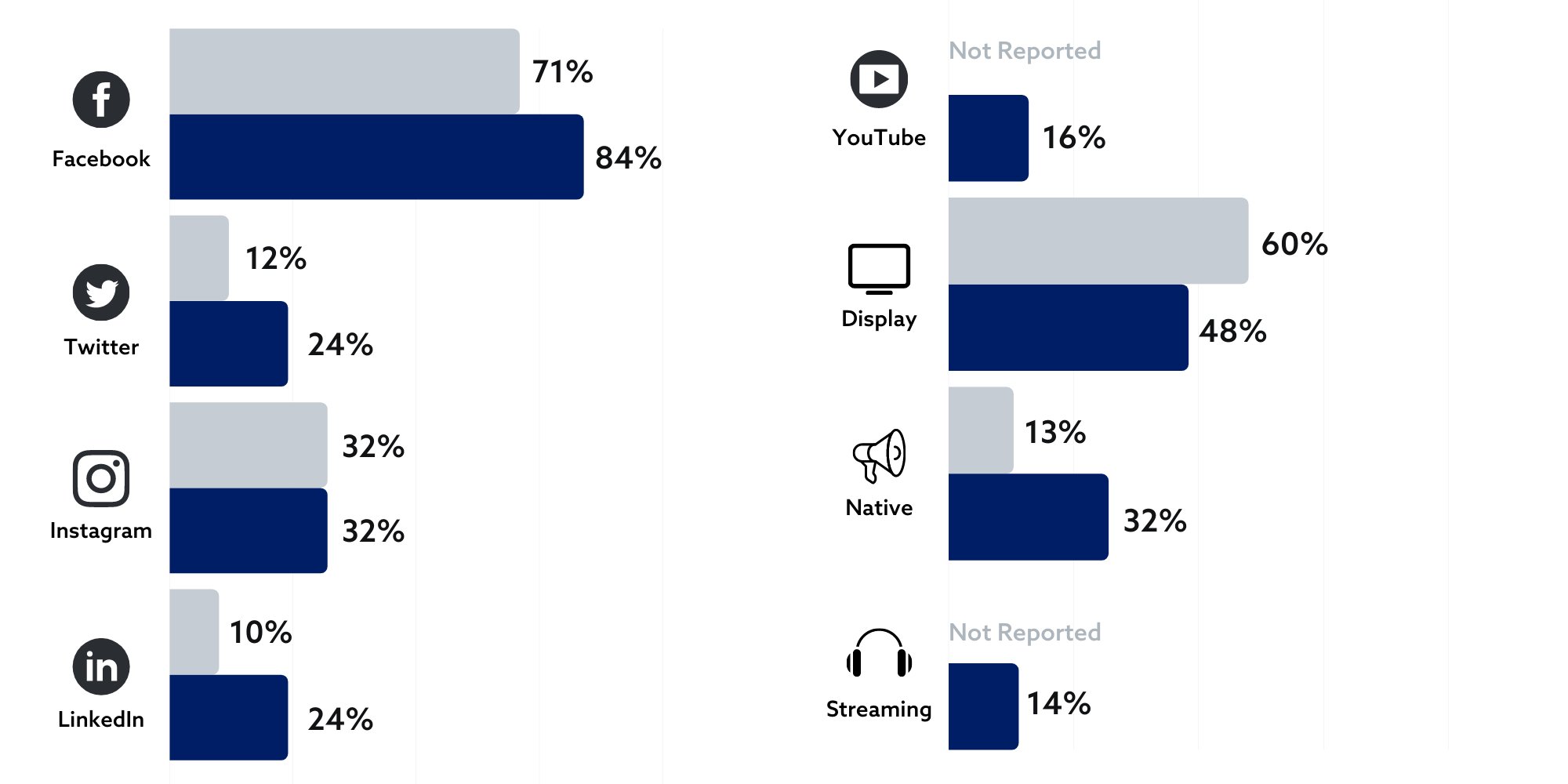

In 2021 we’re seeing budgets move more into digital channels. This year, more organizations invested in paid social and digital marketing compared to 2020. 84% of respondents cited investing in Facebook for paid advertising (a 13% increase over 2020). For Twitter and LinkedIn, paid advertising was at 24%. Those with heftier budgets continued to invest in these channels with a 2% increase in overall digital spend.

Social media platforms give your brand the main stage and the chance to share your story. When investing in paid social, you’ll better reach your target audience and likely improve your return on investment. As we move into 2022, we will continue to see budget reallocated from traditional marketing tactics like print and events, to more digital marketing efforts.

Blue is 2021 and Gray is 2020

Pro Tip:

Marketing is the key for financial brands to reach new customers. See the benefits of utilizing paid advertising and how it could provide greater returns on your investment by reading our blog.

With technology shifts, compliance concerns, and budgeting for 2022, there is a lot to take in. Our upcoming webinar dives into tackling some of these challenges and recommendations as we enter a new year.

If you’re interested in learning more insights from our 2021 Marketing and Compliance Survey, download the full report and watch our webinar that breakdowns the reports key findings.