2020 brought new truth to the expression “a year like no other” – providing twists and turns that few, if any, saw coming.

Our Annual Marketing and Compliance Survey and Report sought to better understand how some of these changes affected the financial services industry and how community financial institutions responded to the challenges.

This year’s report also takes an additional look at how brands regrouped on their marketing strategies and began preparing for next year. For more in-depth insights, be sure to download our marketing and compliance report by clicking the link below.

Our survey was open in September 2020 and received feedback from a variety of different financial brands and internal departments. 92% of our respondents were banks, with insights mainly coming from marketing (72%), compliance (13%), and administration (10%).

The goal of our report was to provide a better understanding of how financial brands are engaging social and digital platforms, critical compliance concerns in financial marketing and trends and outlooks for 2021.

Social Media Marketing

As the world changed in more ways than most of us could expect, this past year saw an accelerated trend for financial brands to turn to social media. While brands grew on all five of the big platforms – Facebook, Twitter, Instagram, YouTube and LinkedIn – it was this last site that grew the most.

Over the past two years, LinkedIn use among financial brand respondents grew over 25%. In 2020 alone, at least 78% of our survey respondents shared having at least one, if not more, LinkedIn pages.

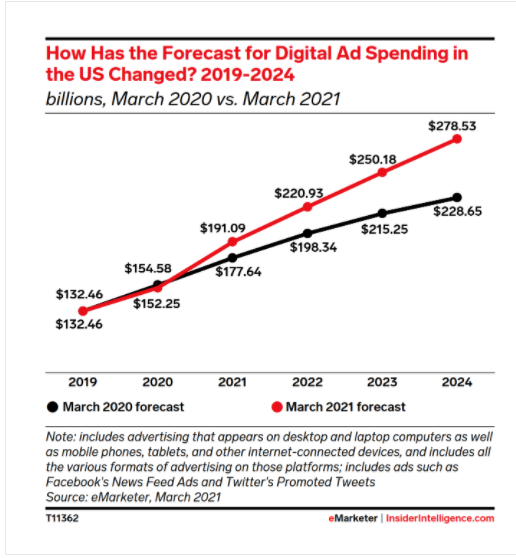

Our analysis on this trend is proving true – which mean the forecasted predictions of another $14 billion dollar increase in digital ad spending remains likely. This is a key area of focus for many industries, including financial services, and should be a key component of your marketing plans moving forward.

How did your brand compare? Did you follow others by capitalizing on this growing trend?

Pro Tip

Brands not only are increasing their presence on social media sites, but they’re also changing the way they use them. Rethink your marketing strategies and how you can optimize your accounts by reading more in our Marketing and Compliance Report.

Digital Listings and Reputations Management

One of the most dramatic changes of the COVID-19 pandemic was the erratic and abrupt nature of branch hours. Locations that were open this week would be closed the next, and customers were often left wondering what information online was accurate.

To better communicate key information like this, 83% of respondents utilized a digital listings service. Including hours and information for ATM locations, branches and banking services was just the start, as financial brands also paid greater attention to their reviews and online reputation.

A strong majority of financial brands, 72%, understand the importance of this resource and began to actively solicit reviews and feedback from their customers.

Pro Tip

With hundreds of different search engines, reviews sites, and automated assistants, financial brands should turn to an automated solution to help them efficiently manage these workflows. To learn more about Social Assurance’s Digital Listings and Reputation Management service, click here.

Community Engagement

This year’s survey also focused on how respondents engaged and communicated their community development activities. Most of the respondents recognize the importance of their community investment and tracking their impact.

The most tracked area for financial brands was donations and sponsorships at 91%. Slightly lower metrics monitoring was seen with volunteer hours (66%), loans (56%), and investments (45%). Tracking information about your involvement not only helps to make audits go smoothly, to also better improve your local community marketing efforts.

Pro Tip

Your financial brand is already passionate about supporting and growing your community – make sure you are communicating your efforts! See how a community development software platform could be for you. Learn more.

Our most recent webinar went further into the numbers and provided a robust discussion on how financial brands can interpret these results.

From better tracking methodologies to how these results could shape 2021, it’s a resource you won’t want to miss! Be sure to view the discussion by clicking here. Don’t forget to download our annual Marketing and Compliance Report by clicking the link below.